As Labour announce a £6 billion commitment for free social care, research by Elder indicates many families may simply be unaware of the funding options they’re already eligible for.

For those who have been through the stress, it will come as no surprise to hear that social care is expensive. Although differing widely across the country, it can be as much as £1100 per week for a bed in a care home.

What’s more, funding currently resembles a diagnosis lottery, where those with certain conditions get their care fully-funded by the NHS, while those with others, such as dementia, may struggle to get any funding at all.

The result is that while many families get some support, there are currently over 6.5 million unpaid carers in the UK, putting their life into caring for those they love.

But the picture may not be as bleak as many think. Recent research by live-in care company, Elder, has found that up to 83% of families are able to pay for care with some form of funding they hadn’t necessarily expected they were entitled to.

Their findings have come from the 2268 families who have used their care funding calculator tool, which gives those looking for care the opportunity to get an estimate of the funding options they’re entitled to.

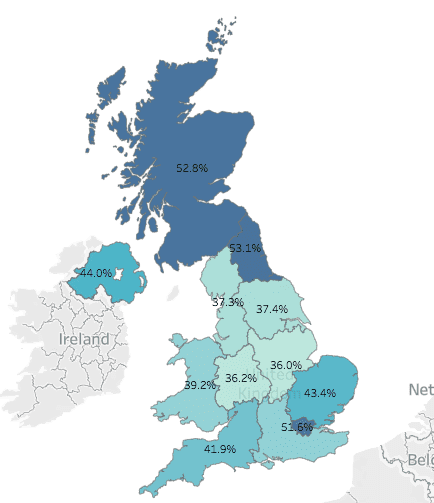

It found just under half (46%) of families are potentially entitled to direct payments from their local council, although this varied across the country.

Estimated direct payment eligibility for live-in care by region

Eligibility for direct payments, where families take control of local authority entitlements, was highest in the North East, where savings are lower. The second was Scotland, although the calculator uses an algorithm based on English thresholds.

Unsurprisingly, due to high property values, London and the South East both vied for the best places to fund care by unlocking the value of your home, with the capital coming out top – where just under 70% of people are likely to be eligible.

The picture across the country showed that equity release could be an under-utilised way to fund care, with it seeming to be a suitable option for 65% of respondents.

Estimated equity release for live-in care eligibility by region

For NHS continuing healthcare, the only public funding stream that covers care costs in full, the picture was constrained. Just 6% were deemed likely to pass the assessments.

The tool assumes families are looking for live-in care, an alternative to the care home where a dedicated carer moves into a spare room, as their solution.

This means that the calculations exclude the value of the home in the hypothetical means test, as per rules around care in the home. Excluding the property value from the evaluation of assets means that eligibility for council funding could be much higher than many realise.

Estimated eligibility for live-in care funding streams

Pete Dowds, CEO of Elder, commented on the findings:

‘More money is always welcome. But our findings show that it’s really important that families get a clear understanding of the funding opportunities they’re already eligible for.’

‘Crucial to that is the difference between the means test for home care versus traditional care home assessments.’

‘Many don’t understand that, with home care, the value of your home is excluded from the means test. This means you’re more likely to get funding from your local authority and you’ll be able to use some of the value of the home to top up, as required.

‘This gives families a sustainable way to get the care they want, which for 97% of people is in their own homes.’

Case study: Stephen’s story

Stephen Fielding was motivated to join Elder after he was saddened at the way the system let him and his family down when they received the heartbreaking news that their mother required social care. This is his story.

‘As a family knowing that a loved one needs care and that you can no longer provide this without professional help is a very hard message to hear, but the pain starts when you have to start navigating the system’, Stephen explains.

‘Our mum had been in and out of hospital and respite homes for about a year when we were told we’d need to find domiciliary care help, at that stage I didn’t even know what this meant, we were given a list of local providers recommended by the council. At this stage, we didn’t have a clue of cost or how we could afford to give our mum the help she deserved.’

At the time of doing a needs assessment, the Local Authority should also carry out a financial assessment to decide on the funding level they will provide towards the care they have deemed necessary.

Stephen’s mum had brought up three children single-handedly and worked as a school secretary until retirement, she had no sizeable savings and lived in rented accommodation.

‘Our mum’s health soon rapidly deteriorated and after further extended hospital stays we were now told she needed full-time care and were again presented with a list of local care homes, mum’s social worker conducted a financial assessment and we were told that she would get some help towards the cost.’

‘I took a day off work and phoned round the homes from the list we were given, some had waiting lists, some were way too expensive, I settled on a couple to visit with my brother and sister.’

‘The second one seemed perfect, they specialised in dementia care, had a garden and visiting was open. They gave us a weekly rate, something like £950. This seemed a lot but we had no idea how much social care cost.’

‘If we’d had access to some form of calculator where we could work out what the council would be paying towards mum care then perhaps we wouldn’t have chosen this home as in the end we had to contribute close to £250 a week as a family top-up. We paid this out of love for our mum but as an open-ended commitment it was a lot.’

‘My advice to anyone looking for care for a loved one would be to push for a financial assessment at an early stage, don’t accept the first figure given – push back and explain you can’t find suitable care within the budget they suggest.’

‘And lastly, if space allows, look into having a live-in carer, they are cheaper than you think and the quality of life for both your loved one and you is vastly better than an institutional care home.’