The first achievement highlighted by the Prime Minister in his Sunday Times article was deficit reduction:

“We’ve got the deficit down by a quarter already”

This statement is true. But what the Prime Minister didn’t say was that the economic outlook the Prime Minister inherited was for precisely this pace of deficit reduction; that’s exactly what the Office of Budget Responsibility was forecasting on the basis of policies in place in May 2010.

At the time, the Prime Minister seemed rather unimpressed by this prospect. Indeed, he argued:

“If we don’t deal with this [the deficit], there will be no growth, there will be no recovery. It will be undercut by rising interest rates, rising inflation, falling confidence and the prospect of higher taxes…So on 22nd June, we will have an emergency Budget, setting out how we will cut the bulk of our deficit over the course of this Parliament, giving this country what it has been desperately lacking – a credible plan to live within its means.”

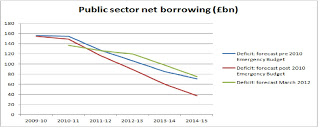

Indeed, we did have an Emergency Budget in June 2010, announcing major tax rises and spending cuts, followed by a Spending Review in October 2010 to flesh out the detail of the cuts. This was supposed to move us from the trajectory shown in the blue line in the chart to that shown in red.

And, two years on,what has been the result? According to the OBR’s March forecast it is the line in green. So the deficit is falling at almost exactly the same pace – maybe a bit slower this year and next – as was projected before any of this.

And, two years on,what has been the result? According to the OBR’s March forecast it is the line in green. So the deficit is falling at almost exactly the same pace – maybe a bit slower this year and next – as was projected before any of this.

It was both foolish and damaging, as I have argued numerous times, for the Prime Minister and Chancellor to liken the UK to Greece, or to suggest that the path of deficit reduction forecast before the Emergency Budget would have led to panic in the gilts market or soaring interest rates. But it is simply bizarre, having done so, and then having delivered almost exactly that supposedly disastrous path, to describe it as a triumph for government policy.

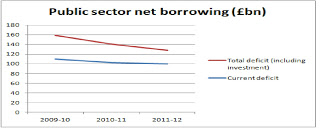

Moreover, it is also important to examine how that deficit reduction – which is real – has occurred. This chart shows the current deficit (ie excluding investment) and the total deficit, including public investment spending.

What it shows is that most deficit reduction – about two-thirds – has come from cutting investment. Given that even at the peak investment spending was only about a tenth of total government spending, this is astonishing. Moreover, it’s getting worse. Last year more than three-quarters of deficit reduction came from cutting investment. Indeed, the current deficit – excluding investment – fell hardly at all, from £102.5 billion to £99.5 billion.

Of course, not all this is the government’s fault. The previous government also planned to slash investment spending. Obviously the broader economic backdrop is much less favourable than was hoped in June 2010 – although this is not some unlucky coincidence for which the government has no responsibility. I and many others would argue it is to a very large extent precisely because of the misguided policies of premature fiscal consolidation implemented not only by the UK government but those making policy in the eurozone. So here’s an alternative, and more accurate, text for the Prime Minister:

“We’ve reduced the deficit by a quarter, in line with the plans we inherited, despite the fact that the misguided policies we and others implemented have made deficit reduction much more difficult. We’ve done this mostly by massive cuts to public investment, despite the fact that the economic circumstances are more conducive to public investment than at any time in living memory. On the bright side, however, we’ve learned that during a period of prolonged weak or zero growth, with businesses and households seeking to raise saving and lower investment, it is possible to continue to finance very large deficits at very low interest rates. “

Jonathan Portes