Taking loan is very normal activity because the unexpected financial problems knock the door anytime. The financial help may be required because of many reasons. Some requirements can be managed, some requirements can be postponed until the financial condition improves and some requirements can be financially reduced while some requirements need to be fulfilled immediately. The growing demand of unsecured loans with bad credit all over the UK is drawing the attention of economists because there are other options also, which are made easily available by the direct lenders.

Direct Lending – A Preference for Bad Credit Unsecured Loans:

The direct lending industry in the UK is trusted for working in the best-organized manner. All the direct lenders are monitored and regularized by Financial Conduct Authority (FCA) – conduct regulator for over 58000 financial services providing firms and lending market in the UK. The involvement of FCA strengthens the trust of potential borrowers. The other reason to prefer the direct lending over the Govt. agency is the friendly support and zeal to lend the money to more and more people. The processing at direct lending agency is too fast if compared to that at Govt. agency. The direct lenders take risk in personal lending to bad credit borrowers also while the Govt. denies the application in most of the cases. The leading direct lenders offer more loan products tailored to diverse needs and preference of borrowers; flexibility in terms and conditions further makes the personal borrowing from private lending agency a favourite choice of UK borrowers.

The Growing Demand of Unsecured Loans with Bad Credit:

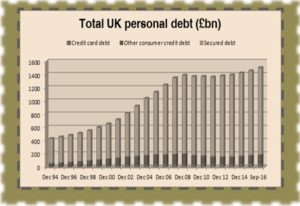

Why do the most of people in the UK apply for unsecured loans with bad credit? Simply, they have bad credit history and nothing to pledge as collateral. In 2017, Bank of England warning over the increasing unsecured debt that surpassed the £200 billion figure; it is first time since 2008. The average household unsecured debt was has £7,413 in June 2017; it is £530 more than the previous year. The unsecured debt in the UK is increasing around 7% per year. According to statistical data shared in 2016, the private debt has crossed the £1.5 trillion figure. As the wages are not increased according to inflation rate, more and more people are turning to take personal loan to meet out the regular expenses. The steep rise in rents also hammers the financial condition of common folk of employed tenant people leaving them unable to meet out even the small emergency expenses without taking loan.

Unsecured Loan for Bad Credit People – Make The Process Perfect:

The wide scale existence of direct lenders in the UK simplifies taking the loan anytime whenever you need. However, the large numbers of borrowers do not feel satisfied after paying back the loan because of higher than the expected cost. There are some potholes on the road of private borrowing; you need to be careful and smart both to make the borrowing journey a pleasant experience.

- Almost 60% UK borrowers are unaware of interest rate they pay for their unsecured debt.

- For the majority of British borrowers, acceptance of loan is more important than the cost.

- Almost 50% British borrowers do not explore the alternative possibilities to avoid unsecured loans for people with bad credit which are made available at higher cost.

- Young Brits in 18-34 years age group constitute 34% of total borrowers approaching to direct lenders; these young borrowers are more likely to accept the loan at higher cost.

- 26% of borrowers paid 2-5% as processing fee just because of not negotiating or exploring other options.

Are You Strategically Ready For the Cheapest Bad Credit Unsecured Loan?

Everyone even with bad credit history wants the cheapest instant decision unsecured loan but the real cost depends upon the strategy you implement from start to finish. The selection of the best online direct lender, proposal and terms and conditions that fits to your requirements and repayment comfort level needs patience, knowledge, determination and a strategy. The well-formulated strategy drives you for the in-depth exploring, zero-in negotiation and on time payment with inner feel of getting the best deal of unsecured loans with bad credit. Think twice and thrice with analytical approach to formulate the practical strategy on real facts.