“no one makes a billion dollars. You TAKE a billion dollars. You take it from your workers…you plunder it from the environment…you strip it using patents/protections” (Stephanie Kelton tweet[i])

Rent-seekers: Who gets the Free Lunch?

Many writers have noted that capitalism concentrates wealth and power into a small number of hands. Up until approximately 1890, economists understood that a key part of the economic system is what are known as rents[ii]. This means unearned income, or excess profits. Recent economic theory does not talk about rents very much — there is an assumption that all income is earned. The people and companies who receive excess wealth from rents are usually described by the media as wealth-creators, but this is partly propaganda. Many of them are ‘rent-seekers’ (also known as rentiers) — people who know how to take money from the system because they understand how it is rigged.

The previous two posts discussed three of the most important ways in which big companies can extract wealth from society. The first is Crony Capitalism where many big companies receive subsidies from governments. The second is Monopoly and Oligopoly, where companies are so dominant in each industry that they can limit competition, charge higher prices and make excess profits. The third is Externalities where companies do not pay the true cost of their activities, such as pollution, global warming and the destruction of the environment.

This post explains other methods that big companies use to extract wealth from society, and to maintain their dominance. Some of the points are discussed in greater detail in other posts, with more examples and references, but it is worth summarising them all in one place to convey the extent to which the system is rigged in favour of the biggest and most powerful companies.

Economies of scale — Size Matters

As a general rule, the more you produce of something, the more cheaply you can make each item.[iii] This means that in many industries it is impossible for small companies to produce things as cheaply as big companies. There are a number of techniques that companies use to establish and maintain dominance.

Spend, spend, spend to become dominant

Big companies have deep pockets to enable them to invest in new industries, and to survive short-term losses whilst they try to establish market dominance early on. This creates what is known as first-mover advantage. This is the business model of Uber, the taxi company. To start with, they pay drivers well and they charge low fares to customers. Once they become dominant, they increase fares and decrease pay to drivers. Despite this, customers and drivers remain loyal, because customers know they can get a taxi quickly, and drivers know they will get regular fares. It is difficult for competing businesses to establish a foothold because initially they don’t have enough drivers to attract customers, or enough customers to attract drivers. When Uber began in the US they paid drivers $40/hour. A few years later they were paying $9/hour.[iv]

More generally, bigger companies tend to have bigger marketing budgets.[v] They spend huge amounts on advertising and on more direct forms of marketing, such as pharmaceutical companies ‘persuading’ doctors to use their medicines.[vi] The role of advertising and marketing to achieve and maintain dominance and excess profits will be discussed in later posts.

One Big Business becomes Many Big Businesses

It is easy for big companies to invest in the same industry in other countries, and sometimes in new industries. Amazon started out selling books, but soon realised that it was well positioned to dominate online selling more generally in much of the world. As with other tech companies, Amazon is also able to make money by collecting and selling immense amounts of data to advertisers, market researchers, and governments.

Many of the biggest companies control different parts of a supply chain. For example, oil companies dig oil out of the ground, refine it in their own refineries, and sell it from their own petrol stations.[vii] They are therefore able to take profit at every stage. They do not have to share the profit with anyone else. (This is known as vertical integration[viii]).

The Global Trade System is Rigged

A number of international organisations such as the International Monetary Fund (IMF), the World Bank, and the World Trade Organisation (WTO) try to force countries to adopt neoliberal economic policies.[ix] This creates huge profit opportunities for global companies.

A company that might only make moderate profits if it dominates in its own country, is able to make spectacular profits if it is able to use its existing knowledge and resources to dominate in many countries. The US government is able to ‘persuade’ other countries to pursue policies that work for US companies, using a combination of threats and bribes. This has contributed significantly to US companies being able to extract wealth from many countries simultaneously. The same applies to a smaller number of big companies from other countries, including Britain and France.

Most people associate corruption with developing countries, but big companies from advanced nations are responsible for paying many of the biggest bribes in order to gain contracts overseas. We saw in an earlier post about the weapons industry that British Aerospace was able to pay a bribe of £7 billion to the government of Saudi Arabia so that they would buy military weapons.[x]

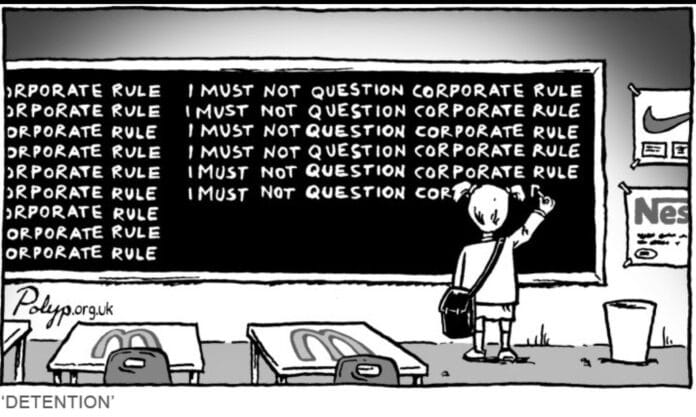

The profit motive encourages companies to exploit everyone else

Most of the business world follows the idea of ‘Greed is Good’ (made famous by the 1980s film ‘Wall Street’). In other words, their main goal is their own profit. However, recent evidence shows that structuring big, dominant businesses to selfishly pursue their own profits does not lead to good outcomes for society. The economist, Mariana Mazzucato, demonstrates in her book ‘The Value of Everything: Making and Taking in the Global Economy’ that modern capitalism encourages businesses to take from the economy.

In practice, the profit motive incentivises companies to exploit people.[xi] There are four main groups of people that get exploited — customers get ripped-off; suppliers get unfair contracts; employees receive low pay and are exploited in many different ways; and governments provide huge subsidies without receiving all the taxes they are owed. Different industries exploit different groups so, for example, banks pay their staff well, but de-fraud customers.

In the previous post we looked at the theory of markets, where companies have to become ‘efficient’ in order to survive. However, in the real world, ‘efficiency’ has become a code that means earning the maximum profit by almost any means, whether legal or illegal. In service industries where the main cost is staff, efficiency means paying staff less, employing fewer staff, giving them less training, making them work longer hours, and putting them on contracts where they have no certainty about how much they will earn each week. In private hospitals, efficiency means turning patients out of their hospital bed before they are ready, so another paying customer can use that bed. In insurance, efficiency means finding ways to not pay out on genuine claims.

Companies offer goods at lower prices, but they are able to do this because they offload some costs onto the customer. A good example is self-assembly flat-pack furniture. Millions of people with poor DIY skills each spend hours interpreting complex instructions and assembling things that can be put together by experts in minutes. By any normal definition, this is very inefficient. If a customer has to wait for a long time when phoning a company helpline, this is similarly inefficient, but profitable for the company.

There are lots of case studies showing that, these days, the profit motive leads to exploitation, and to criminal and unethical activity, much more than it leads to any genuine improvements in efficiency. Later posts will examine in detail the negative things that different groups of companies do.

Corporate Lawyers, Bankers and Accountants Help Companies Bend, Break and Make the Rules

Big companies employ large numbers of lawyers who play multiple roles. They write laws and regulations that benefit their companies, and they set up offshore bank accounts to avoid paying tax. It is estimated that there are currently $20–30 trillion in tax havens.[xii] Together the lawyers and accountants set up complex webs of international companies, so that they can manipulate laws and prices, and hide profits overseas. The main accountancy firms, known as the Big 4, have repeatedly engaged in corrupt accounting, to help companies manipulate their financial statements to avoid tax, and exaggerate profits to mislead investors.[xiii] Most tax avoidance scams are believed to be illegal but are never tested in court. The billionaire, Warren Buffett, has famously pointed out that he pays a lower rate of tax than any of the staff in his office.[xiv]

Privatisation

One of the easiest ways for people with political connections to get much richer is by taking over state industries and extracting profits from them. This is known as privatisation. This includes the privatised infrastructure monopolies such as water, sewerage, healthcare, transport, electricity and energy supplies, and broadcasting and communications spectrum. The agreed sale-price is often well below the true value. Many economists, including one of the leading experts on economic rents, Michael Hudson, has explained that all of these should be public utilities, owned and controlled by the government and provided to everyone at the lowest possible price, so that they cannot be exploited to make excess profits.[xv] Detailed examples of the problems caused by privatisation are discussed in later posts.

Exploiting natural resources provided by nature at no cost, such as oil and minerals. The cost of extracting and processing these resources varies considerably, and is often not related to the price at which they can be sold. Oil and mining companies have been some of the most profitable in the world for many years.[xvi]

Patents and Copyright — being able to charge extremely high prices, and make excess profits, because no other company is allowed to compete against you. This particularly applies to medicines and software.

Criminal Activity — Many of the activities mentioned above, such as price fixing or tax evasion, are illegal. Financial companies have committed multiple huge frauds.[xvii] Big companies are able to get away with their crimes, and effectively operate outside the law, because politicians are reluctant to take serious action against them.

Much of this is missing from economics textbooks

The importance of friends in high places, criminal activity, bribery and corruption, exploitation, power, externalities, and the general extent to which the system is rigged in favour of the rich and the powerful does not receive much attention in economics textbooks. The financial system is also rigged, but does not appear in most economics textbooks at all. Debates about this system have become more prominent in the US in recent years, but this has not yet had any impact on policy.[xviii] In Britain there is still little awareness of just how rigged the system is.

The correct term for this system is rentier capitalism, but this is not helpful for non-economists. We need a better term to allow everyone to talk about this. The civil rights campaigner, Malcolm X, once said

“You show me a capitalist, I’ll show you a bloodsucker.”[xix]

The expression ‘Bloodsucker Capitalism’ seems to accurately describe how British and US companies operate, destroying the planet and our societies along the way.

Key Points

Big companies are able to extract rents (excess profits and unearned income) from the economy in many different ways. The main ones are:

Government subsidies

Externalities — not paying for pollution, global warming, environmental destruction, resource depletion or other costs

Monopoly and Oligopoly

Exploiting staff, customers, suppliers

Resource extraction

Criminal activity — particularly fraud

Privatisations — Giving state enterprises to private companies, and enabling them to extract wealth from more of society

De-regulation — Re-writing the rules to suit big companies. This includes tax manipulation.

Rigged global trade system

Patents and Copyright

We need a name for this system — Bloodsucker Capitalism seems appropriate

Further Reading

Mariana Mazzucato, The Value of Everything: Making and Taking in the Global Economy

Online Resources

Joseph Stiglitz, ‘America has a monopoly problem — and it’s huge’, The Nation, 23 Oct 2017, at

https://www.thenation.com/article/archive/america-has-a-monopoly-problem-and-its-huge/

References

[i] Stephanie Kelton, 22 Jan 2019, at

[ii] Michael Hudson, J is for Junk Economics

[iii] Prateek Agarwal, ‘Economies of Scale’, 13 April 2020, at

[iv] CBInsights, ‘How Uber Makes Money Now’, Dec 2020, at

https://www.cbinsights.com/research/report/how-uber-makes-money/

[v] Business Chief, ‘Top 20 companies with the biggest advertising budget’, 19 May 2016, at

https://www.businesschief.eu/digital-strategy/top-20-companies-biggest-advertising-budget

[vi] Carl Heneghan, ‘The influence of medical marketing’, BMJ, 21 Jan 2019, at

[vii] Kiran Stacey and Ed Crooks, ‘Oil majors find virtue in integration’, FT, 12 June 2016, at

https://www.ft.com/content/8ff8ec62-2dcc-11e6-a18d-a96ab29e3c95

[viii] Evan Tarver, ‘Horizontal vs Vertical Integration: What’s the difference?’, Investopedia, 18 Jan 2021, at

[ix] Richard Peet, Unholy Trinity: The IMF, World Bank and WTO, 2009

[x] Andrew Feinstein: The Shadow World of the Global Arms trade’, talk at Peter Wall Institute for Advanced Studies, 22 Nov 2017, at

[xi] Si Kahn and Elizabeth Minnich, The Fox in the Henhouse: How Privatization Threatens Democracy, 2005

[xii] Nicholas Shaxson, ‘Tackling Tax Havens’, Finance and Development, Sep 2019, Vol.56, №3, at

[xiii] Hanna Ziady, ‘The big 4 audit firms keep failing. Now they’re being forced to change’, 6 July 2020, at

https://edition.cnn.com/2020/07/06/business/uk-big-4-accountancy-firms-frc/index.html

[xiv] https://www-cdn.oxfam.org/s3fs-public/file_attachments/bp210-economy-one-percent-tax-havens-180116-en_0.pdf

[xv] Michael Hudson, ‘The rentier resurgence and takeover: Finance capitalism vs Industrial capitalism’, 27 Jan 2021, at

[xvi] Matthew Taylor and Jillian Ambrose, ‘Revealed: Big oil’s profits since 1990 total nearly $2 tn’, The Guardian, 12 Feb 2020, at

[xvii] ‘Inside Job’, 2010, documentary by Charles Ferguson about the 2008 financial crisis, at

[xviii] Emily Peck, ‘Should Billionaires Even Exist’, Huffington Post, 30 Jan 2019, at https://www.huffingtonpost.co.uk/entry/billionaires-tax-the-rich_n_5c51ea30e4b0ca92c6dcafc6?ri18n

Joseph Stiglitz, ‘America has a monopoly problem — and it’s huge’, The Nation, 23 Oct 2017, at

https://www.thenation.com/article/archive/america-has-a-monopoly-problem-and-its-huge/

[xix] Malcolm X at the Audubon Ballroom, 20 Dec 1964, at

https://teachingamericanhistory.org/library/document/at-the-audubon/

If you like our content please keep us going for as little as £2 a month https://dorseteye.com/donate/