As the new Conservative government seeks to portray itself as the party of business, Molly Scott Cato MEP for the Green Party, has launched a stinging...

Dorset’s chamber of commerce has retained its prestigious status as one of the country’s leading business support organisations. Dorset Chamber of Commerce and Industry...

A highly successful and well respected Dorset law firm is celebrating ten years in business and the expansion of its operation. Simpkins and Co...

Due to funding received from West Dorset District Council and Dorset County Council WSX are delighted to offer this course to those based in the more...

A few blisters were soon forgotten when a team of runners who entered the Bournemouth Half Marathon were able to present a cheque for...

It’s eyes to the skies as the town comes alive for the 2014 Bournemouth Air Festival, but a leading recruitment agency is putting out...

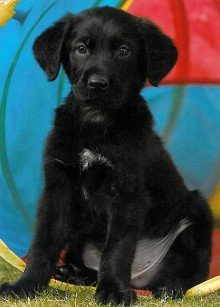

As part of the Company’s ongoing charity initiatives and support, National Locksmith Keytek™ has announced they will be sponsoring a Guide Dog Puppy. ...

If you are running a Dorset based company you will probably come under the category of being an SME (Small to Medium enterprise) or...

Research by Direct Line shows that 65% of Mums with children under the age of 10 are considering starting their own business, why? ...

When it comes to philanthropic acts, many business people play their part in supporting good causes, but a Dorset business man has taken a...