With mounting concerns the outbreak will derail trade, travel and industry, the London-based blue-chip index was at levels not seen since the aftermath of the Brexit vote in 2016 on Friday.

Asian stock markets also plunged further, deepening the financial gloom after the US Dow Jones suffered its biggest one-day drop in its history, falling almost 1,200 points on Thursday.

That took global stock market losses to $5trn (£3.9trn) for the week to date – the FTSE 100’s constituent companies contributing £152bn of that sum ahead of Friday’s session.

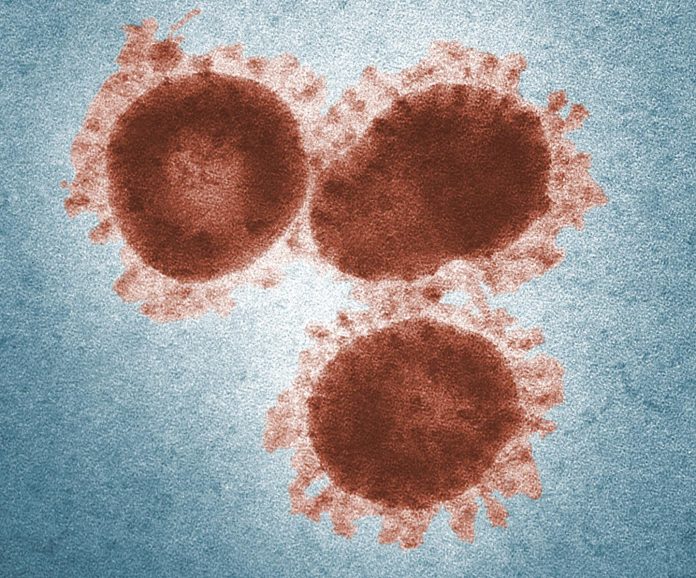

It saw airlines and travel stocks continue to endure the bulk of the losses in London, with BA-owner IAG and easyJet updating the market on their responses to COVID-19, the disease caused by the coronavirus, with flights to Italy cut.

The FTSE 100 was down as much as 4.5% though it later recovered some of those declines as expectations of support from central banks grew.

The week has seen a growing list of major firms warn on sales and profits – mostly the result of factory shutdowns in China disrupting supply chains, as countries around the world try to contain the outbreak.

Oil prices have slumped on expectations industrial activity and demand will shrink drastically – with a barrel of Brent crude oil costing just $50 on Friday. It had been trading at almost $70 last month.

The number of new infections being reported around the world now surpass those in China – shattering hopes that the epidemic would be short-lived and economic activity would return to normal.

Apple and Microsoft, two of the world’s largest businesses, are among those who have said their sales this quarter will be affected.

Norihiro Fujito, an investment strategist, said: “The coronavirus now looks like a pandemic. Markets can cope even if there is big risk as long as we can see the end of the tunnel.

“But at the moment, no one can tell how long this will last and how severe it will get.”

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said: “It is important for investors to understand that the actual sell-off is amplified by a general panic.

“This is the worst week since 2008 and the paranoia grows.”

But she added: “To us, it appears that the market has gone ahead of itself and a rebound should be around the corner.

“The coronavirus outbreak has certainly hit businesses, and it might have a longer-than-expected negative impact on company earnings and global growth.

“Yet the extension of the sell-off we are seeing may be a bit too dramatic, even compared with the significant downshift in valuations.

“Market calamity will certainly leave its place to recovery at some point.”

Some markets around the world have now fallen by more than 10% from their recent highs, putting them into correction territory. There are analysts who believe such a slump was long overdue.

Gold, which investors often flock to during times of uncertainty, is trading close to the seven-year high of $1,688.90 hit earlier this month.

In his final interview before he steps down as Bank of England governor later this month, Mark Carney told Sky News that Britain should prepare itself for an economic growth downgrade as the impact of the COVID-19 outbreak deepens.

However, he said it is too early to tell exactly how the UK will be affected.