LOBO and high risk loans.

LOBO loans are expensive, as they are usually very long term (50-70 years) and have interest rates that are 2-10% higher than current central government rates.

They are also risky, as they contain embedded derivatives in the form of options as indicated by the name LOBO which stands for lender option borrower option.

Due to the embedded derivatives, LOBO loans have been described by financial experts as ‘lose-lose bets’ with the banks: whether market rates go up or down, the loans will be good deals for the banks, while councils always lose out.

Search for your council to view its LOBO loan details, understand how big the problem is, and learn what you can do about it.

Consult the knowledge base for more information about why the loans are bad, how councils got into them in the first place, and what has been done up to now.

What is the current situation in Dorset?

Dorset Council has 8 LOBO loans totalling £75.1 million, including loans that have had their option removed by the bank.

Dorset Council is 48th out of 210 in the ranking of councils with the most LOBO debt.

Since we began monitoring in 2015, this is what happened.

| LOBO loans in 2015 | £95.1 million |

|---|---|

| Term ended | 0 |

| Exited | £20 million |

| Option removed | £15.6 million |

| Remaining total | £75.1 million |

How big is the problem?

Dorset is currently paying £2.97 million in interest per year.

For a sense of scale, this corresponds to 0.95% of what the Council collected in council tax for the year 2020/21.

It is projected to spend at least £108.58 million in interest payments over the remaining term of the loans, the last one ending in 30/07/2077.

The interest rates for Dorset Council’s LOBO loans are between 2.800% and 4.625%. Currently, councils can borrow from central government (via the Public Works Loans Board) at much lower rates (between 1% and 2.5%) and on much more favourable terms. To illustrate, on a loan of £10m over a 50 year term, at 4% a council will pay £20m in interest while at 2% they will pay £10m.

Banks can sell their loans to other lenders. The selling price of a loan varies constantly based on the embedded derivatives and on the likelihood of the loan and interest being paid in full. We’ve rated the loans based on their most recent market valuation, also called fair value. A loan with a high rating will be considered valuable by the lenders and therefore might have a higher exit penalty compared to a loan with a lower rating. However, if the Council were able to negotiate a good exit deal, it could potentially save more on a high-rated loan than on a lower-rated one.

Below is an outline of Dorset Council’s LOBO loans at the end of the 2020/21 financial year.

A few notes on the data:

- Annual interest is a result of an approximate calculation (interest rate*principal), not the exact amount paid by the Council which might vary slightly per year

- Remaining interest indicates the total interest owed until the term of the loan ends. This is also an approximate calculation (annual interest*remaining term) and must be considered as a minimum as it does not take into account the case in which the bank uses its option to raise the interest rate.

- Rating is determined by the formula [fair value/(principal+remaining interest)]. High corresponds to results above 0.7, low to results below 0.6 and average between 0.6 and 0.7. Please note that the fair value of a loan is related to a specific moment in time and changes constantly. The rating here is based on the most recent fair value provided to us, which is usually calculated at the end of the last financial year.

Current loans

| Bank | Principal | Status | Remaining term | Current interest rate | Annual interest | Remaining interest | Rating |

|---|---|---|---|---|---|---|---|

| BAE Systems | £12,000,000 | Active | 39 years | 4.000% | £480,000 | £18,720,000 | No data |

| BAE Systems | £7,500,000 | Active | 38 years | 4.030% | £302,250 | £11,485,500 | No data |

| BAE Systems | £3,000,000 | Active | 39 years | 4.000% | £120,000 | £4,680,000 | No data |

| BAE Systems | £2,500,000 | Active | 38 years | 4.030% | £100,750 | £3,828,500 | No data |

| Barclays | £15,600,000 | Option removed | 56 years | 4.625% | £721,500 | £40,404,000 | Low |

| Lancashire County Council | £15,000,000 | Active | 39 years | 4.390% | £658,500 | £25,681,500 | Low |

| Siemens Financial Services | £10,000,000 | Active | 6 years | 3.190% | £319,000 | £1,914,000 | High |

| Siemens Financial Services | £9,500,000 | Active | 7 years | 2.800% | £266,000 | £1,862,000 | High |

| Totals: | £75,100,000 | £2,968,000 | £108,575,500 |

Previous loans

| Bank | Principal | Status | Date ended | Interest rate at end date | Remaining interest at time of exit | Exit fee | Rating at exit |

|---|---|---|---|---|---|---|---|

| Royal Bank of Scotland | £10,000,000 | Exited | 11/04/2019 | 4.140% | £24,844,537 | £4,555,915 | Average |

| Royal Bank of Scotland | £10,000,000 | Exited | 11/04/2019 | 4.200% | £24,812,219 | £4,780,289 | Average |

| Totals: | £20,000,000 | £49,656,756 | £9,336,204 |

View additional loan details here

What can I do about it?

Some Banks are allowing council’s to exit their LOBO loans early with a reduced penalty fee. If your council holds LOBO loans with these banks, we have listed them below.

For each bank, we provide a list of the loans exited, and when known the exit fee paid. You can see how much a council saved exiting a loan by comparing the penalty fee with the remaining interest at the time of exit. The rating will show how valuable the loan was considered at the end of the financial year before the exit.

For each bank, whether loans have been exited or not, we have listed the other councils that hold or held loans with them. You might want to consider collaborating with councils that still have loans with the same banks to negotiate good exit deals. We also suggest you get in touch with councils that have already exited their loans to learn from their experience.

If you decide to take action, we recommend you bring up the issue within the council and provide the Finance Director with the data on this site, including the downloadable spreadsheet, and the information in the knowledge base. If you struggle to find support within your council, consider seeking independent financial advice. Alternatively, get in touch with us for further guidance.

Royal Bank of Scotland

Royal Bank of Scotland has allowed 34 councils to exit 73 LOBO loans totalling £1.18 billion and has removed the option from 0 LOBO loans totalling 0.

It has 1 outstanding loans with 1 councils totalling £10 million.

| Council | Principal | Date exited | Interest rate at exit | Remaining interest at time of exit | Exit fee | Rating at exit |

|---|---|---|---|---|---|---|

| Birmingham | £10,000,000 | 02/08/2018 | 4.160% | £25,021,545 | £4,289,545 | Low |

| Birmingham | £50,000,000 | 22/11/2018 | 4.120% | £85,238,849 | £17,132,182 | Average |

| Bolton | £18,000,000 | 08/11/2018 | 7.9800% | £60,856,136 | £13,029,274 | Low |

| Brent | £10,000,000 | 29/11/2018 | 7.350% | £30,404,836 | £5,800,000 | Average |

| Brighton & Hove | £10,000,000 | 28/10/2018 | 4.200% | £17,371,890 | £2,910,931 | Average |

| Brighton & Hove | £10,000,000 | 28/10/2018 | 4.220% | £17,454,614 | £2,956,077 | Average |

| Brighton & Hove | £10,000,000 | 28/10/2018 | 4.350% | £17,979,205 | £3,259,933 | Average |

| Cornwall | £40,000,000 | 13/12/2018 | 6.420% | £102,269,721 | £18,460,527 | Low |

| Cornwall | £45,000,000 | 13/12/2018 | 7.500% | £169,156,849 | £35,162,738 | Low |

| Croydon | £20,000,000 | 05/11/2018 | 4.050% | £33,649,397 | £5,178,668 | Low |

| Croydon | £20,000,000 | 05/11/2018 | 4.070% | £33,815,567 | £5,257,237 | Low |

| Croydon | £20,000,000 | 05/11/2018 | 4.250% | £41,344,932 | £6,533,019 | Low |

| Croydon | £20,000,000 | 05/11/2018 | 4.250% | £41,344,932 | £6,539,363 | Low |

| Croydon | £20,000,000 | 05/11/2018 | 4.550% | £39,334,438 | £7,627,304 | Low |

| Darlington | £13,500,000 | 21/12/2018 | 7.320% | £40,627,203 | £8,732,584 | Low |

| Darlington | £13,750,000 | 21/12/2018 | 7.320% | £42,330,908 | £9,008,749 | Low |

| Dorset | £10,000,000 | 11/04/2019 | 4.140% | £24,844,537 | £4,555,915 | Average |

| Dorset | £10,000,000 | 11/04/2019 | 4.200% | £24,812,219 | £4,780,289 | Average |

| East Sussex | £11,500,000 | 29/10/2018 | 4.390% | £19,855,128 | £3,786,041 | Average |

| East Sussex | £11,500,000 | 29/10/2018 | 4.390% | £20,864,828 | £3,881,654 | Average |

| Edinburgh | £15,000,000 | 30/09/2019 | 7.730% | £46,881,921 | Withheld | Low |

| Edinburgh | £10,000,000 | 30/09/2019 | 7.730% | £31,254,614 | Withheld | Average |

| Edinburgh | £10,000,000 | 30/09/2019 | 7.700% | £31,135,425 | Withheld | Average |

| Edinburgh | £5,000,000 | 30/09/2019 | 7.700% | £15,567,712 | Withheld | High |

| Fife | £20,000,000 | 02/07/2019 | 7.770% | £63,215,868 | £18,454,078 | Low |

| Gateshead | £10,000,000 | 23/11/2018 | 3.660% | £15,181,479 | £1,479,079 | Low |

| Gateshead | £10,000,000 | 23/11/2018 | 3.780% | £15,562,208 | £1,755,062 | Low |

| Gateshead | £10,000,000 | 23/11/2018 | 3.820% | £15,490,362 | £1,826,979 | Low |

| Gateshead | £10,000,000 | 23/11/2018 | 3.890% | £16,109,929 | £2,016,282 | Low |

| Gateshead | £10,000,000 | 23/11/2018 | 4.200% | £17,313,205 | £2,742,090 | Low |

| Gateshead | £12,000,000 | 23/11/2018 | 3.995% | £23,670,539 | £2,927,459 | Low |

| Gateshead | £10,000,000 | 23/11/2018 | 4.300% | £17,774,904 | £2,972,939 | Low |

| Harrow | £10,000,000 | 17/10/2018 | 3.650% | £15,107,000 | £1,403,821 | No data |

| Harrow | £10,000,000 | 17/10/2018 | 3.750% | £15,554,795 | £1,640,234 | No data |

| Harrow | £10,000,000 | 17/10/2018 | 4.300% | £17,797,288 | £2,928,589 | No data |

| Hertfordshire | £10,000,000 | 01/11/2018 | 3.900% | £23,414,959 | £2,698,265 | Low |

| Hertfordshire | £20,000,000 | 01/11/2018 | 4.250% | £51,319,041 | £7,379,313 | Low |

| Hounslow | £25,000,000 | 18/10/2018 | 4.170% | £43,145,219 | £6,374,074 | Average |

| Kent | £10,000,000 | 03/10/2018 | 3.950% | £19,892,849 | £2,800,000 | Low |

| Kent | £25,000,000 | 03/10/2018 | 3.830% | £37,227,075 | £5,100,000 | Average |

| Kent | £25,000,000 | 03/10/2018 | 3.830% | £38,189,822 | £5,200,000 | Average |

| Lancashire | £25,000,000 | 01/11/2018 | 6.170% | £64,873,747 | Withheld | Average |

| Lancashire | £25,000,000 | 01/11/2018 | 6.170% | £64,873,747 | Withheld | Average |

| Lincolnshire | £10,000,000 | 12/10/2018 | 3.800% | £15,790,301 | Withheld | Low |

| Luton | £12,000,000 | 14/12/2018 | 4.070% | £20,136,799 | Withheld | No data |

| Luton | £10,000,000 | 14/12/2018 | 3.550% | £14,719,370 | Withheld | No data |

| Newcastle upon Tyne | £10,000,000 | 30/11/2018 | 7.400% | £29,338,466 | £5,963,180 | Average |

| Newcastle upon Tyne | £20,000,000 | 30/11/2018 | 7.400% | £58,705,315 | £11,843,549 | High |

| Newham | £25,000,000 | 03/05/2019 | 7.772% | £79,194,551 | Withheld | Low |

| Newham | £25,000,000 | 03/05/2019 | 7.772% | £79,231,814 | Withheld | Low |

| Newham | £25,000,000 | 03/05/2019 | 7.902% | £80,400,144 | Withheld | Low |

| Newham | £25,000,000 | 03/05/2019 | 7.902% | £80,692,410 | Withheld | Low |

| Newham | £25,000,000 | 03/05/2019 | 7.522% | £76,538,926 | Withheld | Low |

| Newham | £25,000,000 | 03/05/2019 | 7.572% | £77,083,997 | Withheld | Low |

| Northamptonshire | £10,000,000 | 22/10/2018 | 3.990% | £16,532,811 | Withheld | No data |

| Northamptonshire | £10,000,000 | 22/10/2018 | 3.790% | £18,730,907 | Withheld | No data |

| Northamptonshire | £10,000,000 | 03/05/2019 | 7.412% | £30,259,236 | Withheld | High |

| Northumberland | £15,000,000 | 21/09/2018 | 4.260% | £38,250,715 | £5,497,910 | Average |

| Nottinghamshire | £10,000,000 | 21/11/2018 | 3.980% | £19,703,726 | £2,413,230 | Average |

| Redbridge | £5,000,000 | 16/11/18 | 4.140% | £8,104,759 | £1,294,708 | Average |

| Rochdale | £10,000,000 | 21/10/2018 | 3.830% | £15,852,003 | Withheld | Low |

| Salford | £50,000,000 | 20/11/2018 | 6.640% | £134,046,137 | £21,263,519 | Low |

| Sheffield | £20,000,000 | 11/12/2018 | 7.400% | £60,388,055 | £12,330,000 | Low |

| Shropshire | £10,000,000 | 30/06/2019 | 4.050% | £16,478,507 | Withheld | No data |

| Shropshire | £7,000,000 | 30/06/2019 | 4.020% | £11,420,985 | Withheld | No data |

| Solihull | £10,000,000 | 27/09/18 | 4.100% | £16,967,260 | Withheld | Average |

| Telford & Wrekin | £5,000,000 | 02/08/2018 | 4.240% | £8,808,745 | Withheld | Average |

| Telford & Wrekin | £5,000,000 | 02/08/2018 | 3.990% | £9,878,256 | Withheld | Low |

| Telford & Wrekin | £5,000,000 | 02/08/2018 | 3.990% | £9,877,163 | Withheld | Low |

| Telford & Wrekin | £5,000,000 | 02/08/2018 | 3.990% | £9,872,790 | Withheld | Low |

| Tower Hamlets | £60,000,000 | 21/11/2018 | 4.320% | £107,031,847 | £77,852,110 | Low |

| Trafford | £20,000,000 | 01/11/2018 | 7.450% | £61,616,603 | £11,671,000 | Average |

| York | £5,000,000 | 12/10/2018 | 3.600% | £7,489,973 | £568,044 | Average |

| Totals: | £1,184,250,000 | £2,802,274,013 | £389,277,544 |

Councils that still have loans with Royal Bank of Scotland include:North Lanarkshire

BAE Systems

BAE Systems has allowed 1 councils to exit 2 LOBO loans totalling £5 million and has removed the option from 0 LOBO loans totalling 0.

It has 23 outstanding loans with 11 councils totalling £200 million.

| Council | Principal | Date exited | Interest rate at exit | Remaining interest at time of exit | Exit fee | Rating at exit |

|---|---|---|---|---|---|---|

| Gloucester | £1,500,000 | 14/04/2015 | 4.000% | £1,560,986 | £536,250 | No data |

| Gloucester | £3,500,000 | 14/04/2015 | 4.000% | £3,642,301 | £1,251,250 | No data |

| Totals: | £5,000,000 | £5,203,287 | £1,787,500 |

Councils that still have loans with BAE Systems include:Dorset, Durham, Gloucester, Leeds, Lincolnshire, Newcastle upon Tyne, Northumberland, Rotherham, Rugby, Sheffield, Sutton

Barclays

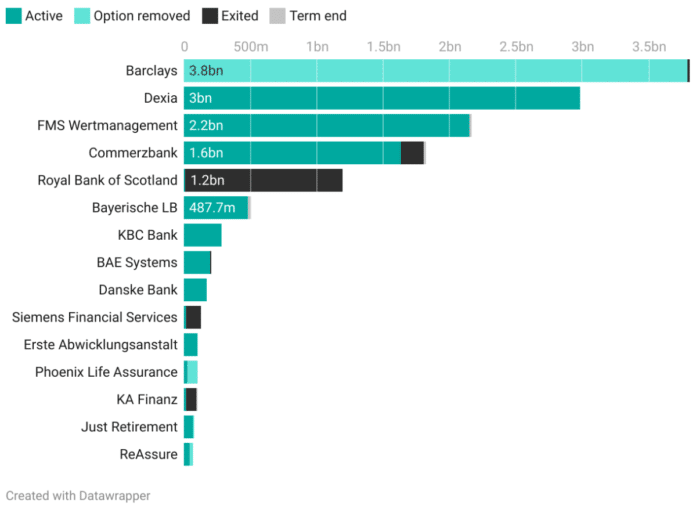

Barclays has allowed 1 councils to exit 4 LOBO loans totalling £20 million and has removed the option from 403 LOBO loans totalling £3.79 billion.

It has 403 outstanding loans with 143 councils totalling £3.79 billion.

| Council | Principal | Date exited | Interest rate at exit | Remaining interest at time of exit | Exit fee | Rating at exit |

|---|---|---|---|---|---|---|

| Gloucester | £5,000,000 | 11/05/2015 | 3.890% | £4,865,697 | £397,000 | No data |

| Gloucester | £5,000,000 | 07/05/2015 | 3.890% | £5,060,730 | £397,000 | No data |

| Gloucester | £5,000,000 | 12/05/2015 | 3.990% | £4,990,779 | £497,000 | No data |

| Gloucester | £5,000,000 | 10/05/2015 | 3.990% | £4,992,419 | £497,000 | No data |

| Totals: | £20,000,000 | £19,909,625 | £1,788,000 |

Councils that still have loans with Barclays include: Aberdeen, Aberdeenshire, Adur, Angus, Antrim & Newtownabbey, Ards and North Down, Argyll & Bute, Ashfield, Barking & Dagenham, Birmingham, Blackburn with Darwen, Blackpool, Bolton, Bradford, Brent, Brighton & Hove, Bristol, Bury, Caerphilly UA, Cambridgeshire, Cheltenham, Cheshire West and Chester, Clackmannanshire, Colchester, Conwy, Cornwall, Darlington, Derbyshire, Devon, Dorset, Dumfries & Galloway, Dundee, Durham, East Ayrshire, East Dunbartonshire, East Lothian, East Sussex, Edinburgh, Essex, Falkirk, Fenland, Fife, Gateshead, Glasgow, Gloucestershire, Great Yarmouth, Greater Manchester, Greenwich, Gwynedd, Hampshire, Harrow, Hartlepool, Hertfordshire, High Peak, Highland, Hillingdon, Hounslow, Inverclyde, Ipswich, Kent, Kingston upon Thames, Kirklees, Knowsley, Leeds, Leicester, Leicestershire, Lincoln, Liverpool, Luton, Manchester, Merton, Midlothian, Milton Keynes, Moray, Newark & Sherwood, Newcastle upon Tyne, Newham, Newport, Norfolk, North Ayrshire, North East Lincolnshire, North Lanarkshire, North West Leicestershire, Northampton, Northamptonshire, Northumberland, Nottingham, Nottinghamshire, Oldham, Oxfordshire, Pembrokeshire, Plymouth, Powys, Preston, Reading, Redbridge, Redcar & Cleveland, Redditch, Rhondda Cynon Taff, Richmond upon Thames, Rochdale, Rotherham, Rugby, Salford, Sandwell, Scarborough, Scottish Borders, Sheffield, Slough, Solihull, Somerset, Somerset West & Taunton, South Ayrshire, South Gloucestershire, South Tyneside, St Helens, Stockport, Suffolk, Sunderland, Surrey, Swansea, Tameside, Telford & Wrekin, Thurrock, Torbay, Torfaen, Tower Hamlets, Trafford, Walsall, Waltham Forest, Warrington, West Dunbartonshire, West Lothian, West Suffolk (Forest Heath), West Yorkshire, Wiltshire, Windsor & Maidenhead, Wirral, Woking, Wokingham, Wolverhampton, Wrexham, Stockton-on-Tees

Lancashire County Council

Lancashire County Council has allowed 0 councils to exit 0 LOBO loans totalling 0 and has removed the option from 2 LOBO loans totalling £20 million.

It has 14 outstanding loans with 8 councils totalling £58 million.

Councils that still have loans with Lancashire County Council include:Armagh, Banbridge and Craigavon, Ashfield, Barking & Dagenham, Dorset, East Dunbartonshire, Merton, South Ayrshire, Trafford

Siemens Financial Services

Siemens Financial Services has allowed 6 councils to exit 11 LOBO loans totalling £108.5 million and has removed the option from 0 LOBO loans totalling 0.

It has 2 outstanding loans with 1 councils totalling £19.5 million.

Councils that still have loans with Siemens Financial Services include:

Dorset

If you like our content please keep us going for as little as £2 a month https://dorseteye.com/donate/