Living on benefits is somewhat becoming a compulsion of the individuals, as they are unable to cover up their regular and irregular expenses from their monthly income. Government in the UK does provide them certain kinds of benefits and they are useful too, but once the financial problem takes a big stride, applying for the loans becomes another compulsion for them. As a result, we can find out plenty of short term and long term loan products are available.

From a long time, a question has been in the mind of the borrowers is, do the lenders agree on giving funds to those living on benefits? If we look at the traditional way of lending, there may be not much chance. Therefore, we need to look at the modern-day FinTech Market where there is a chance of loans for people on benefits. Finding the lender can be done through an extensive online research and then a comprehensive comparison of the interest rates. But why you need those loans? Let us discuss some reasons here:

- Being an unemployed person, you are disheartened not just financially but also mentally. You cannot take a sigh of relief in days or nights. Problems get bigger when the wait for new job goes longer. In such scenario, why not apply for the loans when the lender is ready to offer you despite you are already living on benefits. Stabilise your finances is your primary motive and the loans do exactly.

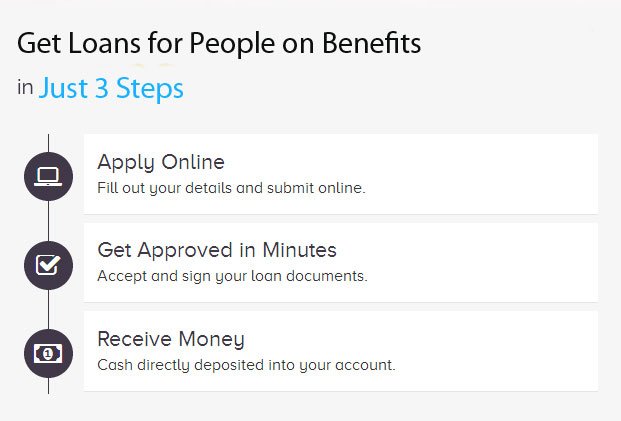

- Nowadays, applying for the loans has become quite easier thanks to the inclusion of the online technology. Most of the lenders are now accepting the online applications because it reduces their time as well as of the borrowers. No paperwork and no faxing are required and everything can be done by sitting at home or office with an internet access.

- Such sorts of loans are extremely important for the disabled people because they often face certain issues like unemployment, and limited funding sources. They can easily fetch funds despite government benefits and the lenders do not have any issue to grant them funds. However, there are few conditions that the borrowers have to follow and the conditions vary from one lender to another.

- The lenders understand the financial compulsions of the people with no job and with a physical disability. Therefore, they are ready to give loans on the flexible interest rates and repayment terms. It is indeed very useful for the borrowers because they do not feel any extra burden while applying for the loans.

Lending Prospects for the Students

When it comes to the government benefits, we cannot leave out the students. They certainly get those benefits while pursuing undergraduate and postgraduate courses. Despite those benefits, they also need a specific financial backup so that they can continue their education without any hassles. In order to save their finances, the lenders in the UK are offering short term loans for students so that they can also rectify their financial issues at earliest. The best thing is that they can also apply despite having a bad credit score, but the scheduled repayments are must for them.