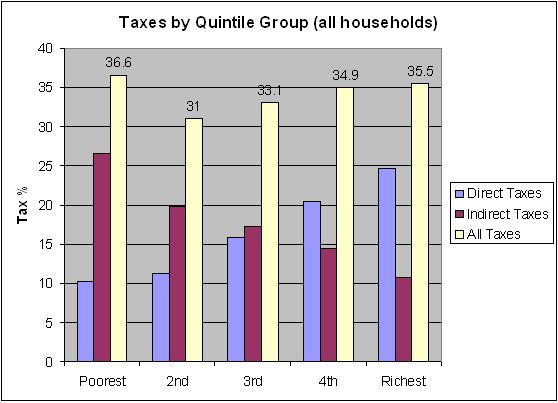

The wealthy and their pals in government and in the media whine that they are over taxed. The fact according to the UK government’s Office of National Statistics is the wealthiest fifth of Britons pay a lower rate of tax than the poorest fifth. ONS figures reveal:

- For every hundred pounds of a rich man’s income £35.50 is paid in tax.

- For every hundred pounds of a poor man’s income £36.60 is paid in tax.

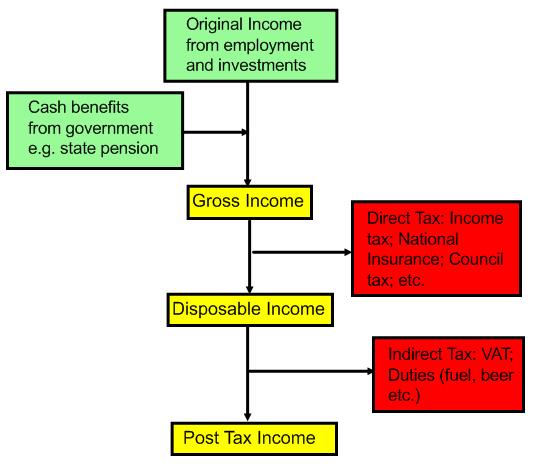

How is this possible? Because these figures include both direct taxes (e.g. income tax) as well as indirect taxes (e.g. VAT).

|

| Each Quintile is 20% (a fifth) of all households, from poorest to richest. |

When hunting for a tax cut the rich lobby only talks about Direct Taxes (income tax, national insurance etc). They conveniently ignore Indirect Taxes (VAT, excise duties etc). Indirect taxes are taxes on spending. The poor spend all they have, while the rich don’t – resulting in spending taxes hitting the poor harder.

The wealthy insincerely promise that if they are allowed to get even wealthier they will pay more taxes to pay for schools, health and the like.

The wealthy insincerely promise that if they are allowed to get even wealthier they will pay more taxes to pay for schools, health and the like.

The truth is if the government actually did want to receive more taxes to pay for schools, health and the like they would give the poor more money, not the wealthy.

The fact is the poor pay a higher rate of tax than the rich.

Why in heaven’s name is this fact not more widely known? Because those who want it known fail to get the message out. And those who don’t want it known succeed in keeping a lid on it!

The solution – share this!

Ripped Off Briton: Looking behind the Headlines