Tax evasion and benefit fraud are two distinct yet interconnected issues that pose significant challenges to the UK economy. Tax evasion involves the deliberate underreporting of income or assets to avoid paying taxes, while benefit fraud refers to individuals dishonestly claiming government assistance or welfare benefits they are not entitled to receive. Both of these illicit activities result in considerable financial losses to the UK government and society at large. In this article, we will explore the amounts lost in the UK due to tax evasion and benefit fraud and their implications for the economy and public welfare.

Tax Evasion in the UK:

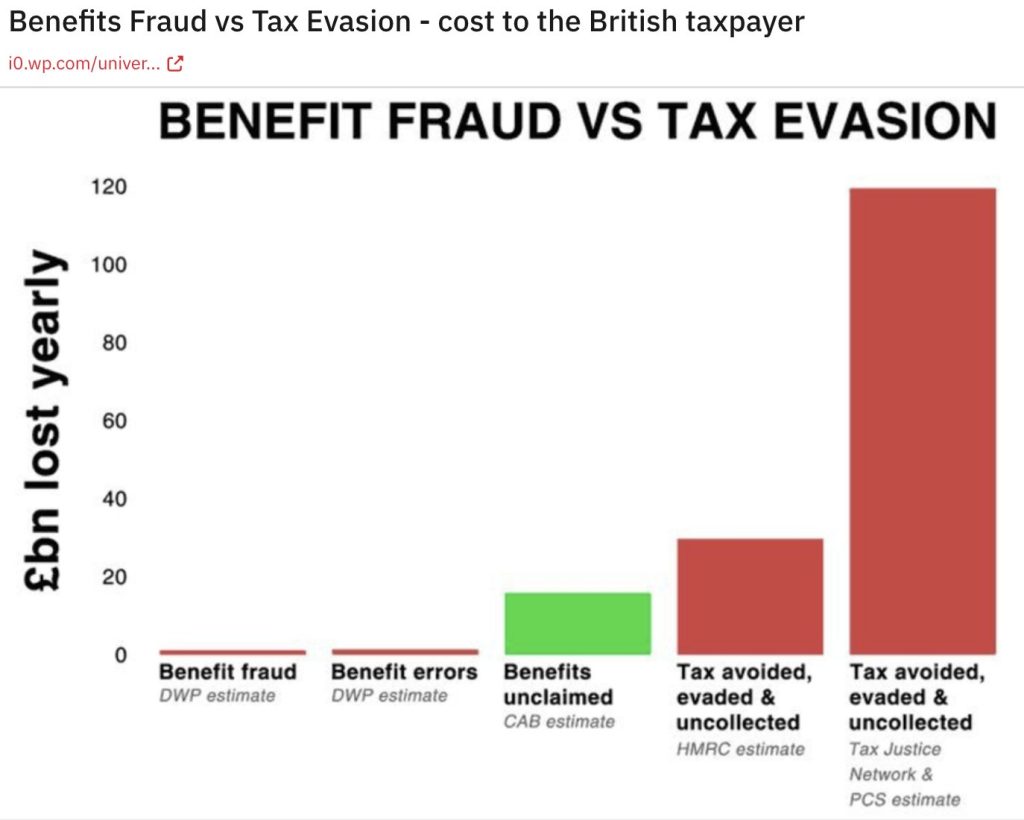

Tax evasion is a pervasive problem in the UK, where individuals and businesses engage in various deceptive practices to reduce their tax liabilities. These practices include hiding income, using offshore accounts, underreporting sales, and submitting false deductions. According to estimates, the UK loses billions of pounds each year due to tax evasion. In 2019, the “Tax Gap,” which represents the difference between what should be collected in taxes and what is actually collected, was estimated to be around £31 billion, accounting for 5.6% of total tax liabilities.

The impact of tax evasion is profound as it affects government revenue, thereby limiting funding for essential public services such as healthcare, education, and infrastructure development. The burden is often shifted onto law-abiding taxpayers, leading to feelings of unfairness and erosion of public trust in the tax system. Additionally, tax evasion undermines the integrity of the tax regime, making it harder for the government to implement effective tax policies.

Since 2014, numerous leaked documents, including the Panama Papers and the Paradise Papers, have exposed a widespread exploitation of the global tax system by powerful corporations and super-rich individuals. This rigged system allows them to evade paying their fair share of taxes, resulting in a significant burden on the world’s poorest populations.

Despite the massive growth in the global economy, with its value nearly reaching $78 trillion in 2017, the gap between the wealthy and the poor continues to widen. The richest 1% now hold more wealth than the rest of the world combined. This extreme economic inequality is primarily fueled by a rampant epidemic of tax evasion and avoidance on an unprecedented scale.

The secret industry of tax evasion thrives on a complex and poorly regulated tax system. Multinational companies and wealthy individuals exploit this system by storing their profits offshore and avoiding taxes in their home countries. Tax havens play a central role in facilitating this process, allowing vast amounts of untaxed wealth to flow secretly beyond the reach of tax authorities and regulators.

The real beneficiaries of this system are the big corporations and super-rich individuals who use their influence and position to reap economic gains for themselves, taking advantage of various tax breaks and loopholes. Many of these practices, although morally questionable, do not break any laws.

Startling statistics show that 9 out of 10 of the world’s top 200 companies have a presence in tax havens, and corporate investments in tax havens have quadrupled between 2001 and 2014. The largest US companies stashed $1.6 trillion offshore in 2015, and Europe’s top 20 banks registered over a quarter of their profits in tax havens in 2015.

The leaked documents, like the Panama and Paradise Papers, reveal that even prominent figures such as celebrities and politicians use tax havens to evade or avoid paying taxes on their substantial fortunes.

Unfortunately, the losers in this system are ordinary people and impoverished countries. When wealthy individuals and multinational corporations avoid paying taxes in the countries where they conduct business, governments lose vital resources needed to provide public services, infrastructure, and social programs. As a result, governments are forced to either cut back on essential services or raise taxes on the general population, leading to a worsening wealth gap and reduced support for the poorest citizens.

This global tax avoidance also has a devastating impact on poorer countries. Corporate tax dodging costs these nations at least $100 billion annually, which could otherwise be used to provide education for millions of children and prevent numerous deaths among mothers and infants. Africa alone loses $14 billion in tax revenues due to the super-rich utilizing tax havens, an amount that could fund healthcare for millions of children and provide sufficient teachers to ensure every African child receives an education.

Benefit Fraud in the UK:

Benefit fraud is another issue that contributes to financial losses in the UK. Individuals might claim welfare benefits deceitfully, either by providing false information about their financial situation or not reporting changes in circumstances that affect their eligibility. Benefit fraud is a complex problem to quantify accurately due to its clandestine nature. However, the Department for Work and Pensions (DWP) estimates that in recent years, fraudulent benefit claims have amounted to several hundred million pounds annually.

The consequences of benefit fraud extend beyond the financial aspect. It can lead to overburdening of the welfare system, leaving genuine claimants with fewer resources and potentially stigmatizing those who genuinely need assistance. Moreover, benefit fraud can strain public trust in the welfare system and lead to increased scrutiny and skepticism of those receiving legitimate support.

Combating Tax Evasion and Benefit Fraud:

Addressing tax evasion and benefit fraud requires a multi-faceted approach involving government agencies, law enforcement, and public awareness campaigns. Increased cooperation between tax authorities and financial institutions to track suspicious transactions and offshore activities can help uncover tax evasion schemes. Moreover, enforcing stricter penalties and enhancing detection capabilities through advanced data analytics can act as deterrents against fraudulent practices.

In the case of benefit fraud, ensuring robust verification processes during application and regular reassessment can help identify and prevent fraudulent claims. The use of technology and data analytics can assist in detecting irregular patterns and discrepancies in claimants’ information. Additionally, promoting public awareness about the consequences of fraudulent behavior can foster a sense of responsibility and discourage individuals from engaging in dishonest practices.

Tax evasion and benefit fraud remain significant challenges in the UK, resulting in substantial financial losses to the government and society. The amounts lost due to these illicit activities impact public services, public trust in the tax and welfare systems, and overall economic stability. Combating tax evasion and benefit fraud requires a collective effort from the government, citizens, and various stakeholders. By implementing stricter measures, promoting transparency, and fostering a culture of compliance, the UK can strive to reduce these losses and ensure a fair and sustainable economy for all.

KEEP US ALIVE and join us in helping to bring reality and decency back by SUBSCRIBING to our Youtube channel: https://www.youtube.com/channel/UCQ1Ll1ylCg8U19AhNl-NoTg AND SUPPORTING US where you can: Award Winning Independent Citizen Media Needs Your Help. PLEASE SUPPORT US FOR JUST £2 A MONTH https://dorseteye.com/donate/