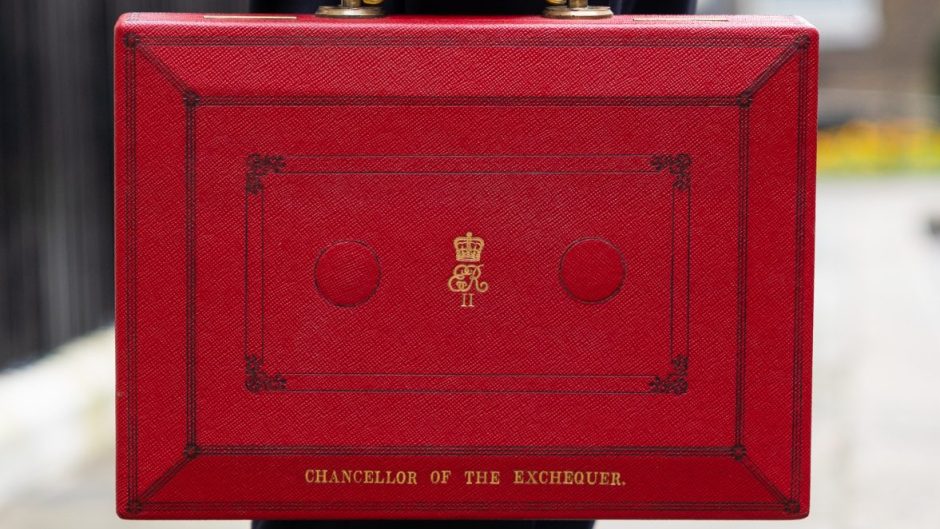

The 2024 Budget, presented by Rachel Reeves, the first woman Chancellor of the Exchequer, outlines Labour’s economic plan with a strong focus on investment, support for public services, and addressing the fiscal challenges left by the previous Conservative government. Reeves announced a notable £40bn rise in taxes to address a £22bn fiscal gap she attributed to Conservative mismanagement, marking the largest tax increase since 1993.

Key Changes:

National Insurance: From April 2025, employer National Insurance contributions will increase from 13.8% to 15%, with the threshold for contributions lowered from £9,100 to £5,000. The Office for Budget Responsibility (OBR) warned that this change could impact workers through lower wages and higher consumer prices, reducing total work hours by approximately 50,000.

Tax Adjustments:

Income Tax Thresholds: The freeze on income tax thresholds will end in 2028/29, after which they will adjust with inflation. This reverses the Conservatives’ freeze, which pushed more people into higher tax bands.

Capital Gains Tax: The lower rate will rise from 10% to 18%, and the higher rate from 20% to 24%, though residential property gains will stay at these rates.

Business Rates: A 40% business rate relief is set for 2025-26, capped at £110,000.

Inheritance Tax and Stamp Duty: Inheritance tax thresholds remain frozen until 2030, while stamp duty on second homes rises to 5%.

Alcohol and Fuel Duties: Duty on non-draught drinks will increase with RPI from February, but draught duty sees a small cut. Fuel duty remains frozen, with a 5p cut upheld.

Additional Measures: Private school fees will attract VAT from January, and employer tax relief for private schools will be removed in April.

Public Spending:

Healthcare and Education: An additional £22.6bn for NHS day-to-day operations and £3.1bn for capital projects, alongside £2.3bn for teacher recruitment and £6.7bn for school infrastructure.

Armed Forces and Roads: £2.9bn allocated to the Armed Forces and £500m to road budgets for next year.

Other Support: £11.8bn for infected blood scandal victims, £1.8bn for Post Office IT scandal victims, and a significant raise in the minimum wage (up 6.7% to £12.21 for over-21s, and a 16.3% increase for 16-20-year-olds).

Economic Strategy:

Investment and Fiscal Responsibility: Reeves stressed Labour’s commitment to investment in economic growth, with a change to fiscal rules allowing more government investment spending.

End to Short-Termism: She pledged “responsible leadership” and an end to Conservative austerity policies, which she argued left public services underfunded.

Pensions: The triple lock on pensions will remain, promising a 4.1% rise next year, benefiting over 12 million pensioners.

Reeves concluded with a promise to “invest, invest, invest” to put “more pounds in people’s pockets” and restore stability, contrasting Labour’s long-term vision with what she termed the “irresponsibility” of past Conservative leadership.