Former Shadow Cabinet member, Chris Williamson, explains that the Labour government, like the Tories before them, are targeting the wrong people in relation to screwing the UK. It is the wealthy who play the fiddle while those who claim benefits are blamed for the broken strings.

THOUGHT FOR THE DAY

— Chris Williamson (@DerbyChrisW) October 23, 2024

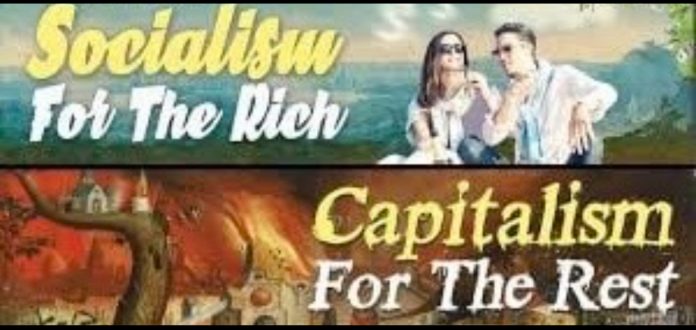

It's wealthy elites, not benefit claimants who are screwing the country. pic.twitter.com/8k914DS1K3

For decades, political discourse in the UK has often centred on the supposed burden that benefit claimants place on the economy. Successive governments, particularly from the right of the political spectrum, have pushed a narrative that the country’s financial woes stem primarily from the cost of welfare. However, a closer examination reveals a much darker truth: it is not the benefit claimants, but the wealthy elites who are truly screwing the country. The systematic exploitation of loopholes, tax avoidance, and policies that favour the rich have had a far more detrimental impact on the British economy than any welfare system could. These are the hidden costs, passed onto the public while the wealthy quietly amass more power and capital.

The idea that benefit claimants are the source of the nation’s economic troubles has been a persistent and misleading narrative. The media frequently focuses on extreme, isolated cases of benefit fraud to paint a picture of widespread abuse. But, in reality, the level of benefit fraud is minuscule. According to government statistics, the estimated level of fraud and error in the UK benefits system is around 2.2% of total benefit expenditure, with fraud accounting for just 1.2%. This represents a small fraction of the welfare budget, far from the dramatic claims of abuse often cited by politicians and the media.

On the other hand, tax avoidance and evasion by wealthy individuals and corporations represent a far greater drain on public resources. According to a report by the Tax Justice Network, the UK loses an estimated £32 billion annually to tax avoidance and evasion. This dwarfs the estimated £2.8 billion lost to benefit fraud each year, yet it rarely makes headlines in the same way. The narrative that the poor are taking advantage of the system distracts from the far more costly practices of the wealthy.

A prime example of this is the use of tax havens. Many of the UK’s wealthiest individuals and largest corporations make extensive use of offshore accounts to avoid paying tax. The Paradise Papers leak in 2017 revealed the extent of this practice, with hundreds of British individuals and companies named as having used offshore accounts in places like the Isle of Man, Bermuda, and the Cayman Islands to reduce their tax bills. These are not small-time fraudsters; they are some of the country’s most powerful and influential figures, including prominent politicians, business leaders, and even members of the royal family.

One such example is the Queen’s private estate, the Duchy of Lancaster, which was found to have invested millions in offshore funds. While perfectly legal, these kinds of investments are ethically questionable, especially given that they allow the wealthy to avoid paying taxes that would otherwise fund public services. It is precisely these services that are being cut in the name of austerity, disproportionately affecting the poorest in society.

The 2008 financial crisis offers perhaps the most glaring example of how the actions of the elite have a far greater impact on the country’s economic health than any welfare system. The reckless behaviour of bankers and financial institutions, driven by a desire for short-term profits, led to the near collapse of the global economy. In the UK, the government was forced to bail out several major banks, including the Royal Bank of Scotland, at a cost of billions to the taxpayer. Meanwhile, those responsible for the crisis walked away with their bonuses intact.

In the aftermath of the crisis, ordinary people were left to bear the brunt of austerity measures, while the wealthy were largely insulated from the impact. Public services were slashed, benefits were cut, and wages stagnated, while the rich continued to accumulate wealth. According to a report by the Institute for Fiscal Studies, between 2008 and 2018, the wealthiest 10% of households saw their incomes increase by an average of 10%, while the poorest 10% saw theirs fall by 13%. This growing inequality is not a result of benefit claimants “scrounging” off the system, but of a system that has been designed to benefit the rich at the expense of the poor.

The government’s response to the COVID-19 pandemic further highlights this disparity. While billions were spent on furlough schemes and emergency loans to keep businesses afloat, much of this money ended up in the pockets of the wealthy. According to a report by the National Audit Office, the government’s Bounce Back Loan Scheme, designed to support small businesses during the pandemic, was widely abused, with an estimated £16 billion of loans lost to fraud and companies with no legitimate need for the funds. Meanwhile, the wealthiest individuals and corporations benefitted from the stock market boom that followed the initial crash, with billionaires such as Sir Jim Ratcliffe and Sir Philip Green seeing their fortunes increase during the pandemic.

The media also plays a significant role in perpetuating the narrative that benefit claimants are to blame for the country’s economic woes, while the actions of the wealthy elite are ignored or downplayed. Tabloid newspapers regularly run stories about so-called “benefit cheats” living luxurious lifestyles on taxpayer money, but rarely focus on the much larger sums lost to tax avoidance and evasion by the rich. This serves to divert attention away from the real source of the problem: a system that allows the wealthy to exploit loopholes and avoid paying their fair share, while demonising the poor for simply trying to survive.

Politicians, too, are complicit in this. Successive governments have implemented policies that disproportionately benefit the rich while cutting support for the poor. The Conservative government’s austerity measures, introduced in the wake of the financial crisis, have been particularly harmful to low-income households. Cuts to welfare benefits, the introduction of the bedroom tax, and the rollout of Universal Credit have all made life more difficult for those already struggling to make ends meet. Meanwhile, tax cuts for high earners and corporations have allowed the wealthy to continue accumulating wealth.

One of the most glaring examples of this is the reduction in the top rate of income tax. In 2013, then-Chancellor George Osborne reduced the top rate of tax for those earning over £150,000 from 50% to 45%. This move was justified on the grounds that it would encourage economic growth by incentivising the wealthy to invest more. However, there is little evidence to support this claim. In fact, a report by the Office for Budget Responsibility found that the tax cut had a negligible impact on economic growth and cost the government billions in lost revenue. This was a direct transfer of wealth from the poorest to the richest, dressed up as economic policy.

The housing market offers another stark example of how the wealthy have manipulated the system to their advantage, at the expense of ordinary people. London, in particular, has become a playground for wealthy investors, many of whom buy property purely as an investment, with no intention of ever living there. This practice, known as “buy-to-leave,” has contributed to the spiralling cost of housing in the capital, making it increasingly unaffordable for ordinary people. Meanwhile, the government has done little to address the issue, preferring instead to focus on welfare cuts and benefit sanctions as a way of reducing the housing benefit bill.

The impact of these policies is clear: inequality in the UK has risen dramatically over the past decade, with the wealthiest 1% now owning more than the bottom 80% combined. This concentration of wealth and power in the hands of a tiny elite is not the result of benefit claimants taking advantage of the system, but of a system that has been rigged in favour of the rich. The poorest in society are paying the price for the greed and excess of the wealthy, and yet they are the ones who are constantly vilified in the media and by politicians.

Even in terms of welfare itself, a significant proportion of the benefits system is actually used to prop up low wages, with the taxpayer effectively subsidising employers who refuse to pay their workers a living wage. According to the Joseph Rowntree Foundation, around 58% of households receiving housing benefit are in work, meaning that it is not the unemployed who are the primary recipients of welfare, but low-paid workers who cannot afford to cover their basic living costs. This is a direct result of government policies that have allowed wages to stagnate while the cost of living has soared, yet the blame is once again shifted onto the poorest in society.

It is worth considering why this narrative persists despite the overwhelming evidence to the contrary. One reason is that it serves the interests of those in power. By focusing the public’s anger on benefit claimants, politicians can divert attention away from the far more damaging actions of the wealthy elite. It is far easier to vilify a single mother claiming housing benefit than to challenge the complex web of offshore accounts and tax loopholes that allow the rich to avoid paying their fair share. Furthermore, by perpetuating the myth that the poor are to blame for the country’s financial problems, the government can justify further cuts to welfare and public services, which disproportionately affect the most vulnerable in society.

Another reason is the influence that the wealthy elite exert over the media and political establishment. Many of the country’s most powerful media outlets are owned by billionaires, whose interests align with those of the wealthy elite. These media moguls have a vested interest in maintaining the status quo, and they use their platforms to push narratives that serve their own interests. This helps to explain why the media is so quick to vilify benefit claimants, while remaining relatively silent on the issue of tax avoidance and evasion by the rich.

Ultimately, the idea that benefit claimants are “screwing the country” is a myth, carefully constructed to divert attention away from the real culprits: the wealthy elite. It is they who are responsible for the widening inequality, the erosion of public services, and the increasing burden placed on the poorest in society. Through tax avoidance, the manipulation of government policy, and the exploitation of loopholes, they have created a system that allows them to amass ever greater wealth, while ordinary people are left to pick up the pieces.

The country is not being screwed by benefit claimants, but by those at the very top. The sooner this reality is acknowledged, the sooner meaningful change can begin.

KEEP US ALIVE and join us in helping to bring reality and decency back by SUBSCRIBING to our Youtube channel: https://www.youtube.com/channel/UCQ1Ll1ylCg8U19AhNl-NoTg AND SUPPORTING US where you can: Award Winning Independent Citizen Media Needs Your Help. PLEASE SUPPORT US FOR JUST £2 A MONTH https://dorseteye.com/donate/