UK Pensions Ranked Among Worst in Developed World, OECD Finds

The United Kingdom’s pension system has been ranked among the worst across developed nations, according to a damning new report by the Organisation for Economic Co-operation and Development (OECD).

The OECD’s latest Pensions at a Glance report paints a grim picture for British retirees, placing the UK near the bottom of the league table for pension adequacy, with many pensioners at risk of falling into poverty. The findings expose deep flaws in the system, sparking renewed concern about how well the country supports its ageing population.

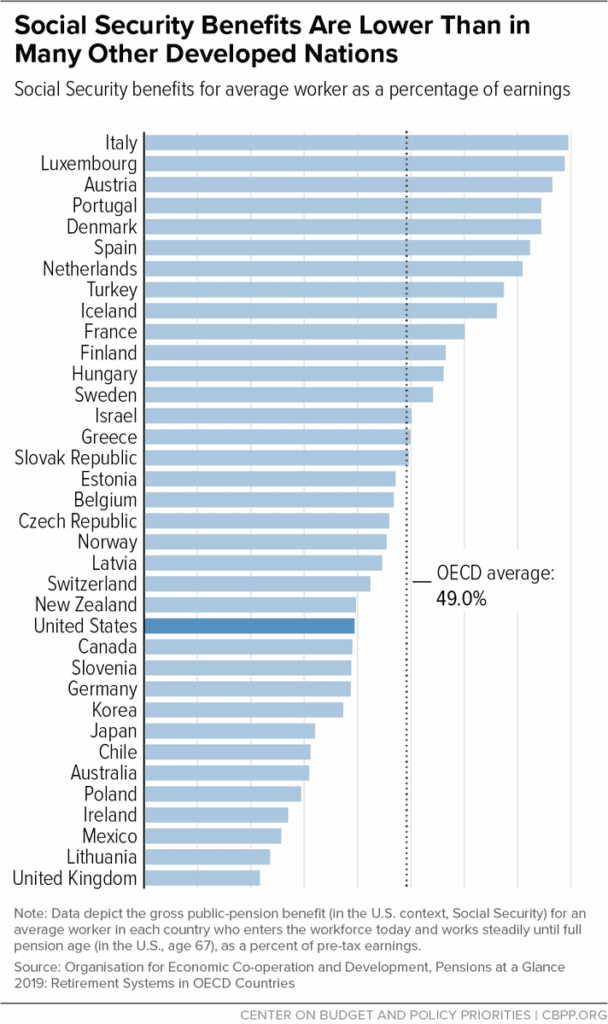

One of the most critical measures used in the OECD’s analysis is the “net replacement rate,” the percentage of a worker’s pre-retirement earnings that is replaced by their pension. The UK’s average replacement rate stands at just 58% for an average earner, significantly below the OECD average of 66%, and far behind top-performing countries such as the Netherlands and Denmark, which offer rates exceeding 90%.

Worse still, for low earners, the UK’s system fares even more poorly. The safety net for those on low incomes is weaker than in many comparable economies, with the basic State Pension and means-tested top-ups offering only limited relief. As a result, older people who have spent much of their lives in low-paid work are among the most vulnerable to financial insecurity.

A key factor behind the UK’s poor ranking is its heavy reliance on private pensions and auto-enrolment schemes. While these have increased overall participation, contributions remain low, and many workers are not saving nearly enough to ensure a comfortable retirement. According to the OECD, workers in the UK are expected to supplement a meagre state offering with substantial personal savings, something that’s simply not feasible for millions dealing with rising living costs and wage stagnation.

The report also highlights stark gender disparities. Women in the UK face significantly lower pension incomes than men, largely due to career breaks, part-time work, and the gender pay gap. Moreover, the growth of the gig economy and insecure, self-employed work has excluded many from consistent pension saving altogether.

The findings have led to renewed calls for urgent reform. Experts warn that without significant changes, including increasing state pension generosity, raising minimum auto-enrolment contributions, and expanding access to workplace pensions, the UK risks creating a growing class of pension-age citizens who are forced to work longer or live in poverty.

Dr. Frances O’Grady, former General Secretary of the TUC, said:

“It’s a national disgrace that in a country as wealthy as ours, people who have worked all their lives are being left behind in retirement. This report should serve as a wake-up call to policymakers.”

The Department for Work and Pensions has defended the current system, pointing to recent increases in the State Pension and the success of auto-enrolment. However, critics argue these measures are not enough to address the growing shortfall and inequality.

The OECD’s findings underscore a harsh truth: Britain’s pension system is failing many of its citizens. Without decisive action, the gap between the UK and its global peers will continue to widen, leaving millions of future retirees in an increasingly precarious position.