For all the noise about collapsing stock markets, something far subtler and far more dangerous forced Donald Trump into a rare, uncomfortable retreat. And with it, the carefully cultivated aura of his unshakeable power began to fracture.

Following his sudden and aggressive imposition of sweeping tariffs, most attention had zeroed in on the immediate market fallout. Global equity markets tumbled, and conventional wisdom assumed this alone would be enough to shake the president’s resolve.

After all, Trump has always worn Wall Street’s success as a badge of honour. During his first term, he relentlessly tied his fortunes to the surging S&P 500, hailing it as the clearest proof of his economic genius.

Yet last week, with stocks reeling, he appeared remarkably unfazed. He dismissed the turmoil as a bitter but necessary “medicine” to cure America’s trade woes. As ever, the performance was one of defiance; a president prepared to face down the markets in pursuit of his nationalist agenda.

But beneath the bravado, the ground was shifting.

What initially looked like a familiar market pattern – falling stocks offset by rising bonds, a traditional flight to safety – soon morphed into something altogether more alarming. For the first time in years, both stocks and US government bonds sank in unison.

The significance of this cannot be overstated. The yield on the benchmark 10-year US Treasury bond, the bedrock of American borrowing costs, started the week at 4.00%. By early yesterday, it had leapt to 4.51% — an astonishing move in such a short time.

Such a rise matters profoundly. The 10-year yield influences the rates on everything from mortgages and car loans to credit cards. Higher yields translate directly into higher costs for ordinary Americans and businesses alike. In effect, Trump’s tariffs were inadvertently engineering a stealth tax on the very people he claims to champion.

Behind the scenes, alarm bells were clanging.

True, fears of inflation stoked by tariffs played a role. So did the dismal demand at the Treasury’s latest bond auction. But the real drama came from the heart of the financial system, where hedge funds were forced into a frantic unwinding of complex ‘basis trades’ — strategies that exploit price gaps between physical bonds and their futures contracts.

Ordinarily, such trades are routine. But as bond prices collapsed, hedge funds — many of them deeply leveraged — scrambled to sell, triggering a cascade that drove yields even higher.

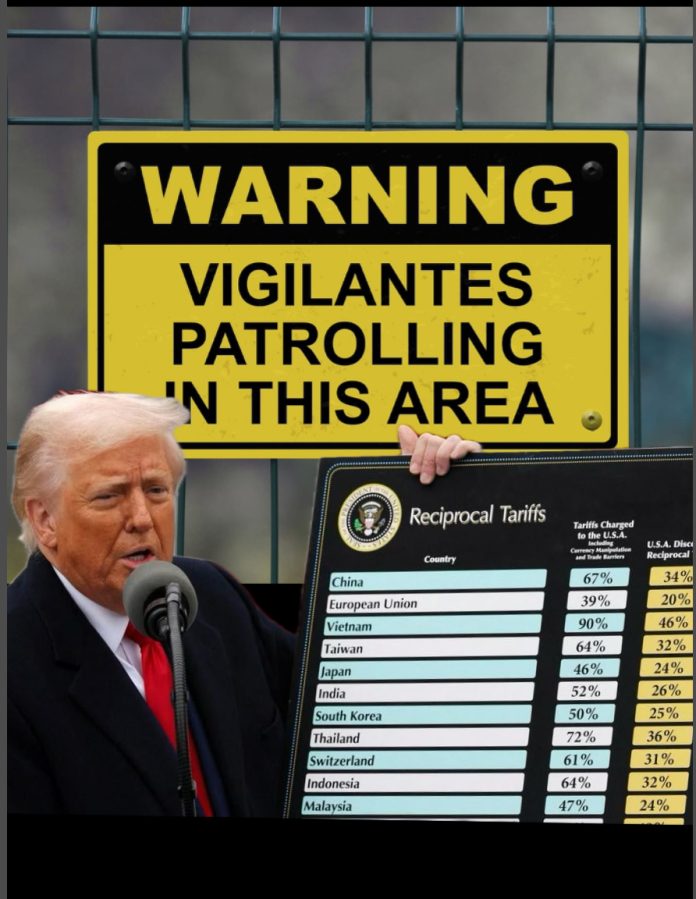

This is when the so-called “bond vigilantes” — a loose alliance of investors willing to punish governments for perceived economic folly — made their decisive intervention.

By dumping US Treasuries en masse, they delivered a searing rebuke to the president’s economic management. The message was blunt: ignore us at your peril.

For a man who has long projected himself as a master negotiator and market whisperer, it was a chastening moment. Trump, who had previously wielded emergency executive powers with impunity, suddenly found himself outmanoeuvred by forces he could neither command nor control.

The consequences were immediate. Faced with the spectre of soaring borrowing costs across the economy, the White House began quietly rowing back its tariffs. The market’s response was euphoric. Equities staged a stunning comeback — the Nasdaq saw its second-best day in history, while the S&P 500 posted its third-best session since the Second World War. US Treasury bonds also rebounded.

Goldman Sachs swiftly revised its recession forecast, trimming the odds from 65% to 45%, sensing that the worst had been averted — for now.

Predictably, Trump sought to mask the climbdown, brushing off the market chaos and dismissing investors as having grown “a little bit yippy, a little bit afraid”.

But the truth is unavoidable: he blinked.

And in doing so, he shattered one of the pillars of his political persona. Here was a president who had promised to bend the world to his will, forced instead to yield to the invisible hand of the markets. It is a bruising blow to his credibility, not just at home but on the global stage.

Yes, volatility may yet return. The threat of tariffs hangs ominously over the months ahead, and the trade war with China simmers dangerously.

But the veneer of invincibility has cracked. Wall Street has reminded the world — and Trump himself — that even the most powerful office cannot defy economic gravity forever.