Let’s start here:

"No wonder they're spitting their dummies out… 'Pay tax, that's only for the poor and middle class, isn't it?'"@Matthew_Wright mocks the 'billionaire-owned newspapers' choosing to back the likes of Jeremy Clarkson in the row over farmer inheritance tax reforms. pic.twitter.com/wcA04wdxdz

— LBC (@LBC) January 26, 2025

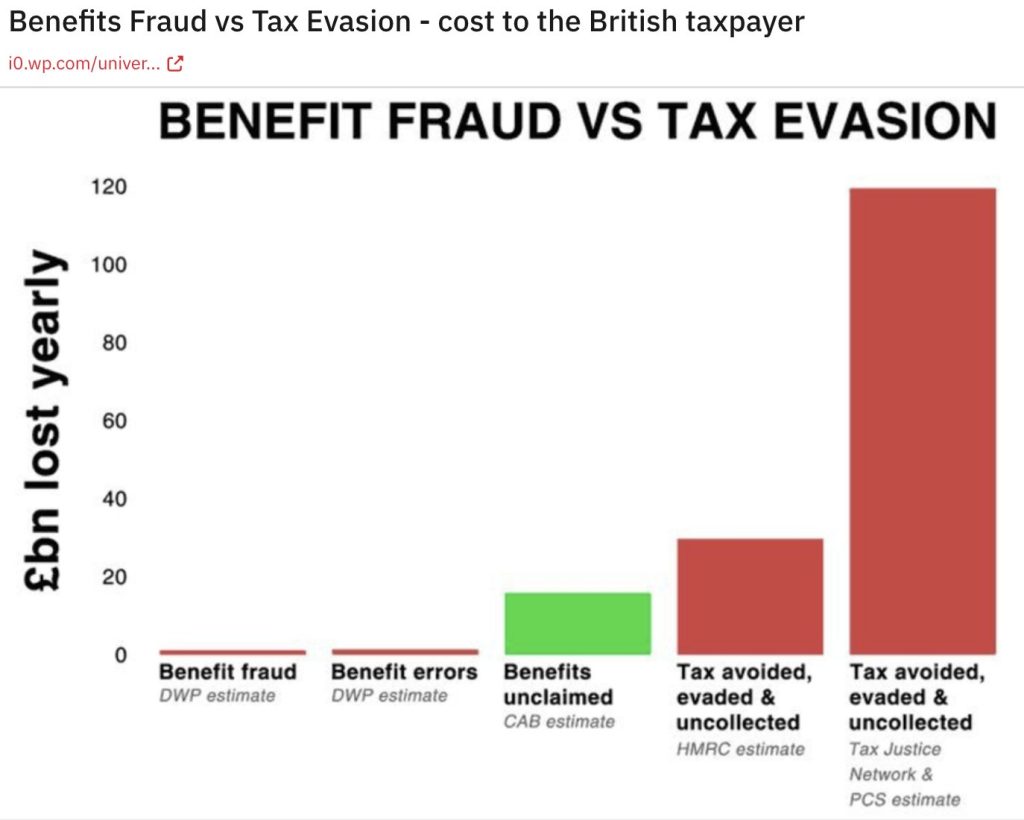

Following yet another attack on ‘benefit cheats’ by the political establishment, I thought it would be a wonderful idea to focus the attention on those who starve the country of literally tens of billions every year. Yes exactly! Those who avoid and evade their duty to pay their taxes to maintain a healthy society. For those who lack an understanding of the discrepancy between those who deny the country what is legally theirs in taxes in comparison to fraudulently claiming benefits, this should enlighten considerably.

Tax evasion and avoidance by the super wealthy represents one of the most significant threats to the fabric of our society. It undermines the ability of governments to fund essential public services, erodes trust in institutions, and creates gross inequalities in wealth distribution. To address this persistent issue, here is a robust 10-point plan to punish offenders and deter future violations.

1. Persistent Offenders to be Sent to an Internment Camp in Eritrea

Extreme cases of tax evasion demand equally severe consequences. Persistent offenders, those who evade taxes repeatedly and demonstrate no remorse, should be sent to an internment camp in Eritrea, a nation with a reputation for harsh conditions. This measure is not merely punitive but also symbolic, sending a global message that tax evasion will not be tolerated. Such offenders will experience life under stringent circumstances, mirroring the struggles they impose on society by shirking their responsibilities. The harsh reality of these camps will act as a deterrent for others considering such actions.

2. Removal of British Passports

A British passport is a privilege, not a right, particularly for those who exploit the nation’s resources while refusing to contribute their fair share. Tax evaders should face revocation of their British passports, making them stateless or requiring them to apply for citizenship elsewhere. The removal of this privilege would strip offenders of the protections and benefits they seek to exploit, such as access to UK healthcare, infrastructure, and global prestige.

3. Names and Images Published in Neon Lights in Town and City Centres

Shaming is a powerful tool, and public exposure can act as a deterrent. Town and city centres across the UK should feature prominent displays in neon lights of the names and images of convicted tax evaders. These displays should remain in place for a defined period, ensuring that the public is aware of those who undermine society. Such public shaming would be a stark reminder that evading taxes is a betrayal of the community and the nation.

4. Punchbags Featuring the Faces of Tax Evaders

As a novel and therapeutic measure, gyms and fitness centres should be equipped with punchbags bearing the faces of prominent tax evaders. This initiative would serve a dual purpose: allowing citizens to vent their frustrations physically and raising awareness about the damage caused by tax avoidance. These punchbags could even be sold commercially, with proceeds going to fund public services, creating a direct link between public accountability and tangible societal benefit.

5. Curriculum Reforms: Highlighting the Damage of Tax Avoidance

Education is a critical component of long-term change. GCSE and A-level courses in Theology, History, Politics, and Economics should include a dedicated section examining the societal damage caused by tax avoidance and evasion. By embedding this topic into the curriculum, young people will gain an understanding of the ethical, economic, and social consequences of these actions, fostering a culture that values fairness and responsibility from an early age.

6. Punishments for Complicit Accountants

Accountants who knowingly assist clients in avoiding or evading tax must face significant consequences. This would include a lifetime ban from practicing accountancy, coupled with mandatory community service of at least 1,000 hours cleaning public toilets. This dual punishment serves as both a deterrent and a means of reparative justice, ensuring that those who facilitate financial crimes contribute directly to the upkeep of public facilities.

7. Liquidation of Companies Engaged in Tax Evasion

Corporate tax evasion is often facilitated through complex schemes and loopholes. Any company found guilty of tax evasion should face immediate liquidation, with all assets seized by the state. The directors of such companies should be barred from forming or running another business for at least ten years. This approach ensures that corporate actors understand the severe consequences of exploiting the tax system while preventing repeat offences by the same individuals.

8. Mandatory Ethics Course and Examination

Those who evade or avoid tax, or assist others in doing so, should be required to attend a year-long ethics course. The course would educate offenders on the societal harm caused by their actions, culminating in a rigorous three-hour examination. To pass, participants must achieve a score of at least 80%. Failure to meet this benchmark would result in additional sanctions, including extended courses or financial penalties. This measure seeks to reform offenders by fostering a deeper understanding of their responsibilities to society.

9. National Poster Campaign for Those Escaping Conviction

For individuals who attempt to escape conviction through legal loopholes or procedural delays, a nationwide poster campaign should expose their actions. Posters featuring their names, faces, and details of their offences would be displayed in prominent public spaces, ensuring that the public is aware of their crimes. This measure would discourage attempts to evade justice while maintaining public accountability.

10. Forfeiture of Re-Entry Rights for Those Who Flee

Tax evaders who flee the country to avoid prosecution must face irrevocable consequences. Those who leave the UK to escape justice will forfeit the right to return unless they pay the full amount owed, along with a 50% administration charge. This policy ensures that fleeing offenders cannot escape their obligations without facing significant financial and social penalties. Additionally, their assets within the UK would be frozen or seized, further discouraging attempts to abscond.

The Rationale for This Plan

Tax evasion and avoidance are not victimless crimes. They deprive societies of the resources needed for healthcare, education, infrastructure, and social welfare. The super wealthy, who benefit disproportionately from these public services and protections, have a moral obligation to contribute their fair share. This 10-point plan is designed not only to punish offenders but also to create a culture where tax compliance is the norm and evasion is met with severe consequences.

By combining education, public accountability, and robust legal measures, this plan aims to address the root causes of tax evasion while deterring future violations. It is time for society to take a firm stand against those who undermine the collective good for personal gain.