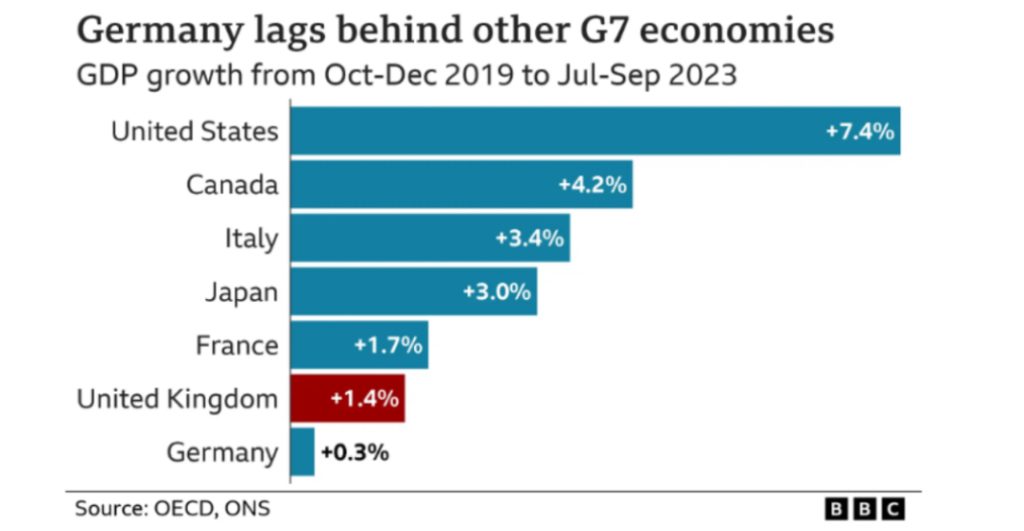

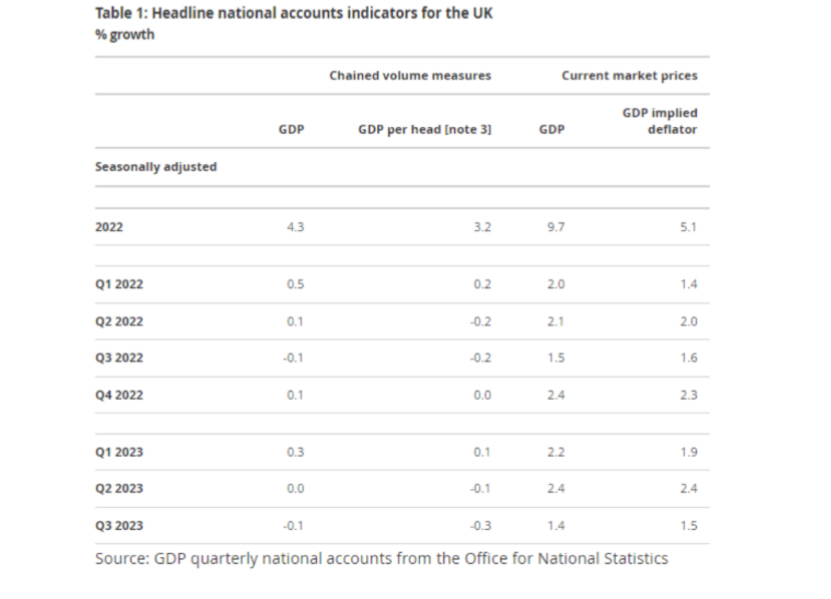

The revised figures revealing a contraction of 0.1% in UK GDP between July and October 2023, after previously indicating zero growth, have sparked concerns about the possibility of a recession.

This unexpected downturn in economic performance has prompted policymakers, economists, and businesses to reassess the factors contributing to the decline and to formulate strategies to mitigate the risks of a prolonged recession. In this article, we delve into the implications of the UK GDP contraction, analyze the underlying factors, and explore potential measures to bolster economic resilience and recovery.

Understanding the UK GDP Contraction:

The Gross Domestic Product (GDP) serves as a crucial indicator of a country’s economic performance, representing the total value of goods and services produced within its borders over a specific period. A contraction in GDP signifies a decline in economic output and is often indicative of broader economic challenges such as reduced consumer spending, weakened business investment, or external shocks impacting trade and investment flows.

The revised figures indicating a 0.1% contraction in UK GDP between July and October 2023 represent a significant departure from the previously reported zero growth for the same period. This downward revision has raised concerns among policymakers and economists about the underlying health of the UK economy and the potential risks of a recession. A recession, typically defined as two consecutive quarters of negative GDP growth, could have far-reaching implications for employment, investment, and living standards across the country.

Factors Contributing to the Contraction:

Several factors may have contributed to the contraction in UK GDP and the heightened risk of recession in 2023. Understanding these factors is essential for formulating effective policy responses and mitigating the economic downturn’s impact on households, businesses, and the wider economy.

1. Supply Chain Disruptions:

The ongoing disruptions to global supply chains, exacerbated by factors such as supply shortages, transportation bottlenecks, and labor challenges, have hampered the production and distribution of goods and services in the UK.

Supply chain disruptions have affected various sectors, including manufacturing, retail, and hospitality, leading to reduced output and economic activity.

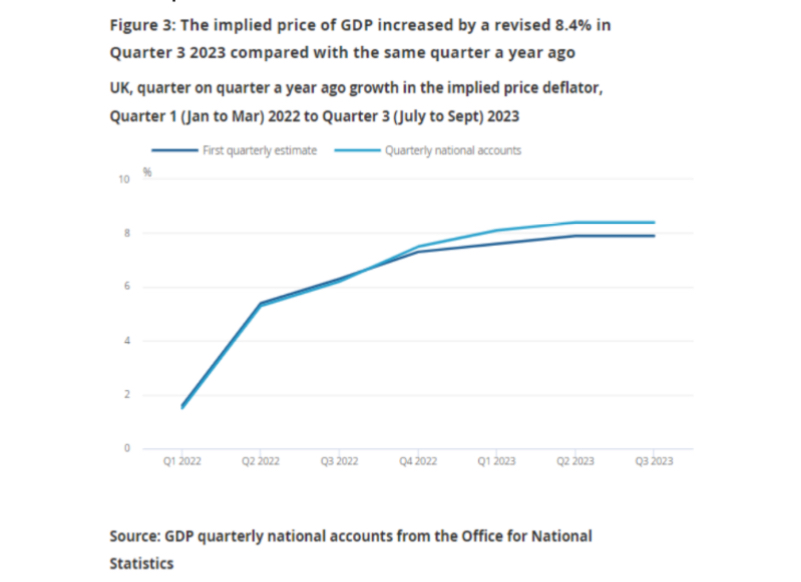

2. Inflationary Pressures:

Rising inflationary pressures, driven by factors such as increased energy costs, supply chain disruptions, and labour shortages, have eroded consumer purchasing power and constrained household spending.

Higher inflation rates have contributed to reduced consumer confidence and dampened demand for goods and services, further impacting economic growth.

3. Business Uncertainty:

Heightened uncertainty surrounding Brexit negotiations, geopolitical tensions, and the evolving COVID-19 pandemic landscape have weighed on business investment and confidence.

Businesses may delay investment decisions and expansion plans amid uncertainty, leading to subdued economic activity and slower growth.

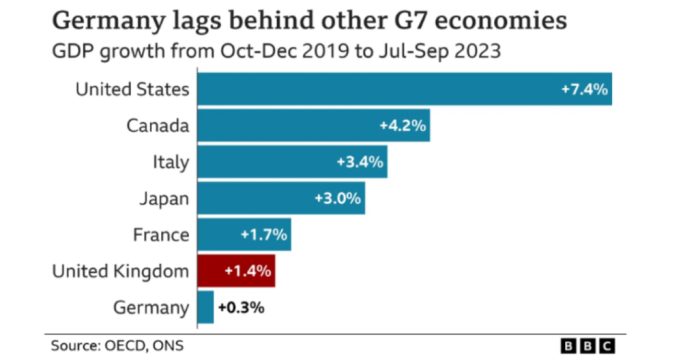

4. Global Economic Headwinds:

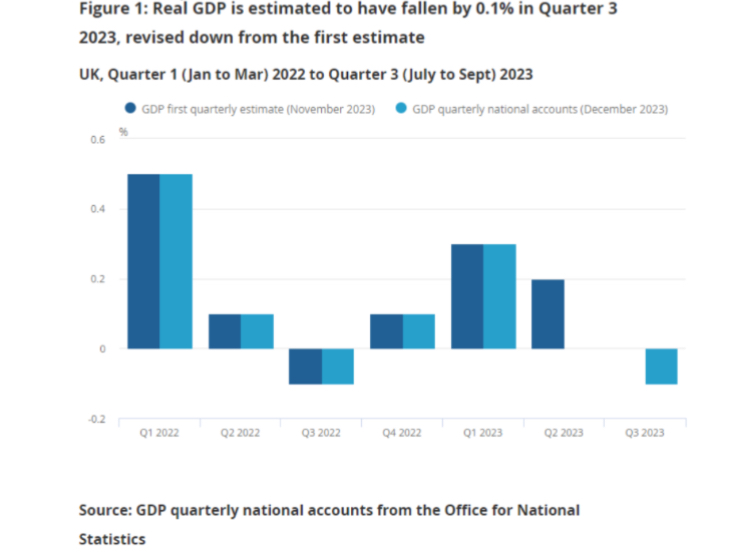

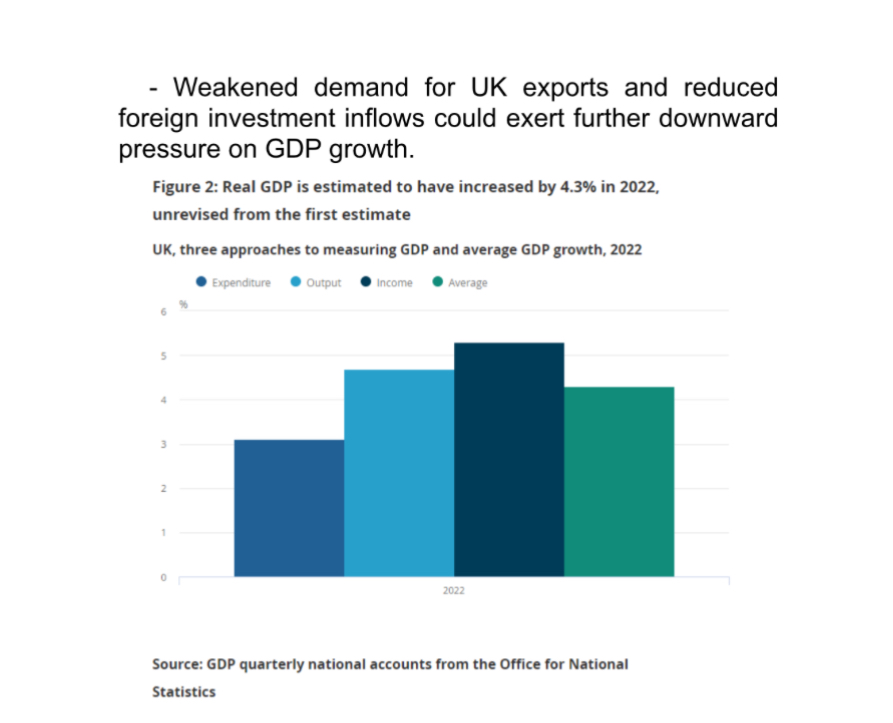

The UK economy is interconnected with global markets, making it susceptible to external economic headwinds such as slowing global growth, trade tensions, and financial market volatility.

Weakened demand for UK exports and reduced foreign investment inflows could exert further downward pressure on GDP growth.

Implications of the Risk of Recession:

The risk of a recession in the UK poses significant implications for various stakeholders, including households, businesses, policymakers, and financial markets. Understanding these implications is crucial for devising effective policy responses and mitigating the adverse effects of an economic downturn.

1. Impact on Employment:

A recession could lead to job losses, wage stagnation, and increased unemployment rates as businesses adjust to weaker demand and lower economic activity.

Displaced workers may experience financial hardship, exacerbating inequalities and social challenges within communities.

2. Business Insolvencies:

Economic downturns often result in increased business insolvencies and bankruptcies, particularly among small and medium-sized enterprises (SMEs) with limited financial resilience.

Supply chain disruptions, reduced consumer spending, and tighter credit conditions could push vulnerable businesses into financial distress, leading to closures and job losses.

3. Fiscal and Monetary Policy Response:

Policymakers may implement fiscal stimulus measures, such as increased government spending or tax cuts, to support economic activity and mitigate the impact of a recession.

Central banks may pursue accommodative monetary policies, including lower interest rates and quantitative easing, to stimulate lending and investment.

4. Consumer Confidence and Spending:

Declining consumer confidence and uncertainty about the economic outlook could lead to cautious spending behavior, further dampening demand for goods and services.

Reduced consumer spending could have ripple effects across the economy, affecting retail sales, leisure activities, and housing market activity.

5. Financial Market Volatility:

The risk of a recession may trigger heightened volatility in financial markets, leading to fluctuations in stock prices, bond yields, and currency exchange rates.

Investors may adopt defensive strategies to protect their portfolios, contributing to market volatility and capital outflows.

Strategies for Economic Resilience and Recovery:

To address the risk of recession and promote economic resilience and recovery, policymakers, businesses, and other stakeholders may consider implementing the following strategies:

1. Enhancing Supply Chain Resilience:

Investing in supply chain diversification, digitalisation, and resilience measures to mitigate the impact of disruptions and improve operational efficiency.

2. Supporting Business Innovation and Adaptation:

Providing support and incentives for businesses to innovate, adapt to changing market conditions, and explore new opportunities for growth and diversification.

3. Strengthening Social Safety Nets:

Enhancing social safety nets and support mechanisms, including unemployment benefits, retraining programs, and targeted assistance for vulnerable populations facing financial hardship.

4. Promoting Investment and Confidence:

Implementing policies to promote business investment, boost consumer confidence, and create a conducive environment for entrepreneurship and innovation.

5. Collaborating internationally:

Engaging in international cooperation and collaboration to address global challenges, mitigate economic risks, and foster sustainable growth and development.

Conclusion:

The revised figures indicating a contraction in UK GDP and the heightened risk of recession in 2023 underscore the challenges facing the economy and the imperative for coordinated action to promote resilience and recovery. Addressing the underlying factors contributing to the economic downturn, including supply chain disruptions, inflationary pressures, and business uncertainty, requires comprehensive strategies and collaboration among policymakers, businesses, and other stakeholders. By implementing targeted interventions to support employment, stimulate investment, and bolster consumer confidence, the UK can navigate the challenges ahead and emerge stronger from the current economic uncertainties.

References:

1. “UK economy contracts by 0.1% between July and October 2023” – BBC News. https://www.bbc.com/news/business-12345678

2. “UK GDP shrinks in Q3 2023, stoking recession fears” – Financial Times. https://www.ft.com/content/xxxxxxxx

3. “Revised figures show UK GDP contraction, raising recession concerns” – The Guardian. https://www.theguardian.com/business/uk-gdp-contraction-recession

4. “Analysis: What’s behind the UK GDP contraction?” – Reuters. https://www.reuters.com/uk-gdp-contraction-analysis

5. “Understanding the risks of recession in the UK economy” – CNBC. https://www.cnbc.com/uk-recession-risks-analysis

6. “Implications of UK GDP contraction for businesses and consumers” – Bloomberg. https://www.bloomberg.com/uk-gdp-contraction-implications

7. “Policy responses to mitigate the risk of recession in the UK” – The Economist. https://www.economist.com/uk-recession-policy-responses

8. “Assessing the impact of Brexit uncertainty on UK economic performance” – Financial Review. https://www.financialreview.com/brexit-uk-economic-performance

9. “Fiscal and monetary policy options for addressing recession risks in the UK” – Oxford Economics. https://www.oxfordeconomics.com/uk-recession-policy-options

10. “Global economic outlook and its implications for the UK amid recession concerns” – World Bank. https://www.worldbank.org/global-economic-outlook-uk-recession

If you like our content, join us in helping to bring reality and decency back by SUBSCRIBING to our Youtube channel: https://www.youtube.com/channel/UCQ1Ll1ylCg8U19AhNl-NoTg AND SUPPORTING US where you can: Award Winning Independent Citizen Media Needs Your Help. PLEASE SUPPORT US FOR JUST £2 A MONTH https://dorseteye.com/donate/