Debenhams’s owners have begun drawing up plans for the liquidation of the 242-year-old department store chain in a move that could trigger the single-biggest jobs cull of the coronavirus pandemic.

Sky News has learnt that Debenhams has appointed Hilco Capital, which specialises in helping to wind down distressed retail businesses, to work with it in the event that a sale process for one of Britain’s best-known retailers ends in failure.

Hilco’s role was described this weekend as “contingency planning” by people close to the company as it seeks to secure its future ahead of the crucial pre-Christmas trading period.

Debenhams employs roughly 14,000 people, having announced this week that it was shedding a further 2500 members of its workforce.

The chain, which trades from just over 120 stores across the UK, had already axed more than 4,000 jobs since the pandemic struck.

The liquidation of its stock and other assets would inevitably spell grim news for most of Debenhams’s remaining staff.

Since the start of the pandemic, British Airways’ proposal to cut 12,000 jobs – a figure which remains under review and is expected to be reduced – has been the largest prospective cull by a UK-based company.

Tens of thousands of jobs have also been lost across the high street as retailers and hospitality businesses have borne the brunt of the crisis.

The department store sector has been far from immune, with the John Lewis Partnership recently announcing that 1300 jobs were at risk as a result of a reorganisation of its business.

Debenhams has been in administration since April, when the nationwide coronavirus lockdown brought many retailers’ revenues to a sudden halt.

This month, the company and its hedge fund backers – which include Silver Point Capital and GoldenTree Asset Management – launched an auction through the investment bank Lazard in an attempt to secure new investors.

A number of parties are said to have expressed an interest, although analysts believe it is unlikely that a buyer will emerge for Debenhams in its current form.

The company wants to conclude the sale process by the end of next month.

In a statement this weekend, a spokesman for the department store chain said: “Debenhams is trading strongly, with 124 stores reopened and a healthy cash position.

“As a result, and as previously stated, the administrators of Debenhams Retail Ltd have initiated a process to assess ways for the business to exit its protective administration.

“The administrators have appointed advisors to help them assess the full range of possible outcomes which include the current owners retaining the business, potential new joint venture arrangements (with existing and potential new investors) or a sale to a third party.”

The company declined to comment specifically on the involvement of Hilco, but one insider pointed to administrator FRP Advisory’s responsibility to establish whether Debenhams could trade solvently, be sold or liquidated.

The business has performed ahead of expectations since the bulk of its stores were able to reopen in June and does not need to borrow money for the foreseeable future, the insider added.

Hilco, which briefly acquired the Oasis and Warehouse brands after they collapsed into administration earlier this year, also worked with Debenhams on the permanent closure of 18 stores this year.

The drawing up of contingency plans for Debenhams’s liquidation represents another turbulent chapter for a business which traces its roots to 1778.

It fell into administration in the spring of last year after a bitter public battle with the Sports Direct tycoon Mike Ashley, whose Frasers Group had become its biggest shareholder.

Mr Ashley is reported to want to acquire up to 30 of Debenhams’s sites.

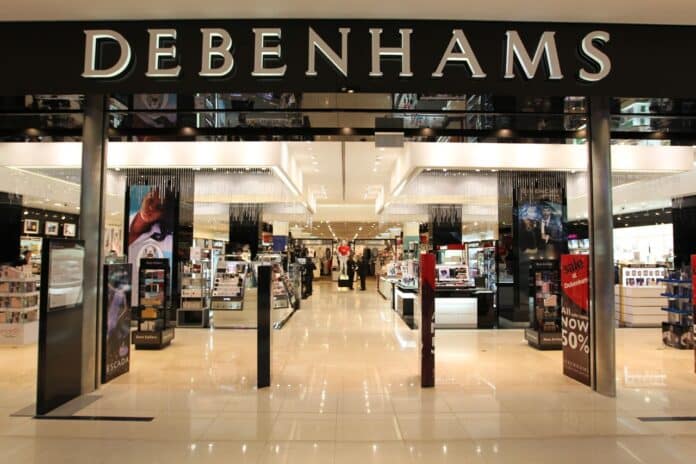

For much of its history, Debenhams was highly profitable, becoming an established anchor tenant on many high streets and in shopping centres around the UK.

It relisted on the London stock market in 2006 following a spell in private equity ownership that proved lucrative for CVC Capital Partners and TPG but which left its balance sheet saddled with what proved to be unsustainable debts.

After its first spell in administration, Debenhams launched a company voluntary arrangement (CVA) to secure agreement for store closures and rent cuts.

It has also liquidated its Irish business and closed support operations overseas, although it continues to own a Danish department store chain.

The parlous state of UK retailing meant a further restructuring was always possible, even before the coronavirus crisis.

Hilco could not be reached for comment on Saturday.