An Introduction

The Greensill scandal of recent years serves as a stark reminder of the complex interplay between finance, politics, and corporate governance. At its core, the scandal revolves around the collapse of Greensill Capital, a financial firm that specialised in supply chain financing and the subsequent fallout that reverberated through the financial world.

Greensill’s business model was built upon the concept of supply chain financing, which aimed to expedite payments for companies by allowing them to borrow money against their invoices. This seemingly innovative approach attracted significant attention and investment from major financial institutions and prominent figures, including SoftBank and former British Prime Minister David Cameron, who worked for Greensill as an advisor.

However, as the intricacies of Greensill’s operations unraveled, several critical issues emerged. One of the primary concerns was the extensive reliance on a single client, particularly the involvement with British steel magnate Sanjeev Gupta’s GFG Alliance. Greensill’s heavy exposure to GFG Alliance raised questions about the concentration of risk within its portfolio.

Furthermore, the scandal shed light on the blurred lines between business, politics, and lobbying. David Cameron’s involvement in lobbying government officials to gain access to COVID-19 financial support schemes for Greensill Capital generated substantial controversy, sparking inquiries into potential conflicts of interest and ethical concerns.

The downfall of Greensill Capital sent shockwaves through the financial sector, leading to discussions about the regulation of supply chain financing and the need for greater transparency in corporate practices. Regulators and policymakers scrutinised the risks associated with such financial models and the potential systemic implications of their failures.

The Greensill scandal serves as a cautionary tale, highlighting the importance of robust regulatory frameworks, transparency in financial dealings and the need for checks and balances to prevent conflicts of interest. It underscores the interconnectedness between financial institutions, businesses and political figures, emphasising the necessity for clear boundaries and ethical conduct.

Moving forward, the aftermath of the Greensill scandal prompts discussions and reforms aimed at tightening regulatory oversight, fostering greater accountability and reinforcing the ethical standards governing the intersection of finance, politics and corporate governance.

The Greensill scandal stands as a stark reminder of the vulnerabilities within the financial system, the risks associated with unchecked corporate practices and the importance of upholding integrity and transparency in all facets of business and politics.

David Cameron’s role

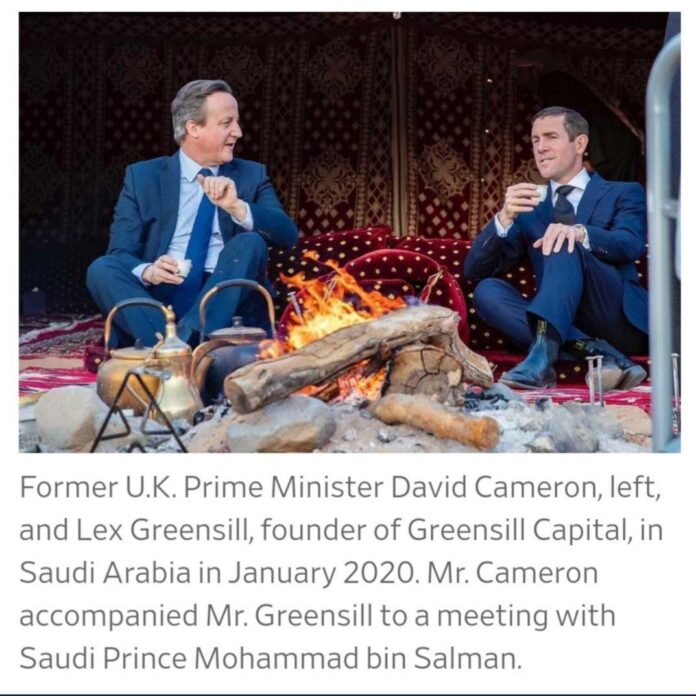

David Cameron’s involvement in the Greensill scandal stems from his position as an advisor to Greensill Capital after he stepped down as the UK’s Prime Minister in 2016. His role as a paid advisor to Greensill has raised significant scrutiny and controversy due to his lobbying efforts on behalf of the company.

Cameron’s access to high-ranking government officials and his use of personal connections to influence decision-makers in the British government drew attention. Reports revealed that he lobbied senior ministers and officials, including Chancellor Rishi Sunak and Health Secretary Matt Hancock, seeking access to government-backed COVID-19 financial support schemes for Greensill Capital.

Specifically, Cameron communicated via text messages and emails with government officials, advocating for Greensill’s inclusion in the COVID Corporate Financing Facility (CCFF), a program aimed at supporting businesses during the pandemic. His messages to officials, including informal communications with the Treasury, raised questions about potential preferential treatment and the extent of his influence in securing access to financial aid for Greensill Capital.

The controversy surrounding Cameron’s actions highlighted concerns about the revolving door between politics and the private sector. Critics argued that his lobbying efforts blurred ethical boundaries and emphasised the need for clearer regulations regarding the activities of former government officials in lobbying for private firms.

While Cameron defended his actions by stating that he believed Greensill’s services could help support small and medium-sized businesses during the economic crisis triggered by the pandemic, his involvement nonetheless ignited debates about transparency, conflicts of interest and the influence ex-politicians wield in the corporate world.

Ultimately, Cameron’s role in the Greensill scandal underscored the complexities and ethical dilemmas surrounding the interactions between former high-ranking political figures and private entities, prompting discussions on the need for stricter regulations and transparency in lobbying practices.

How the corporate lobbyists run the world

Explained in precise detail:

Jason Cridland

If you would like your interests… published, submit via https://dorseteye.com/submit-a-report/

Join us in helping to bring reality and decency back by SUBSCRIBING to our Youtube channel: https://www.youtube.com/channel/UCQ1Ll1ylCg8U19AhNl-NoTg SUPPORTING US where you can: Award Winning Independent Citizen Media Needs Your Help. PLEASE SUPPORT US FOR JUST £2 A MONTH https://dorseteye.com/donate/