It’s true, from April 2014, you can tell HMRC what you think your code should be by explaining why you think its wrong, here is a link to the HMRC structured E Mail

This form can only be used for queries relating to your PAYE Coding Notice. Any other queries will not be answered.

HMRC aim to respond within 15 days of receiving your E Mail.

Checking your tax code

You’ll find your tax code on:

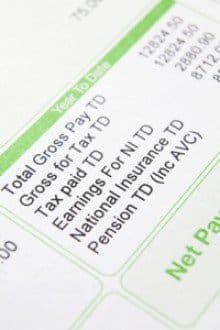

- your pay slip

- your PAYE Coding Notice – you usually get this a couple of months before the start of the tax year and you may also get one if something has changed but not everyone needs to get one

- form P60 – you get this at the end of each tax year

- form P45 – you get this when you leave a job

Your tax code can be wrong for lots of reasons so being able to sent a structured E Mail to HMRC should help to get things corrected faster.