For those unaware, this is a great place to start:

As of September 2023, approximately 38% of Universal Credit claimants in the UK were employed, equating to over 2.3 million individuals.

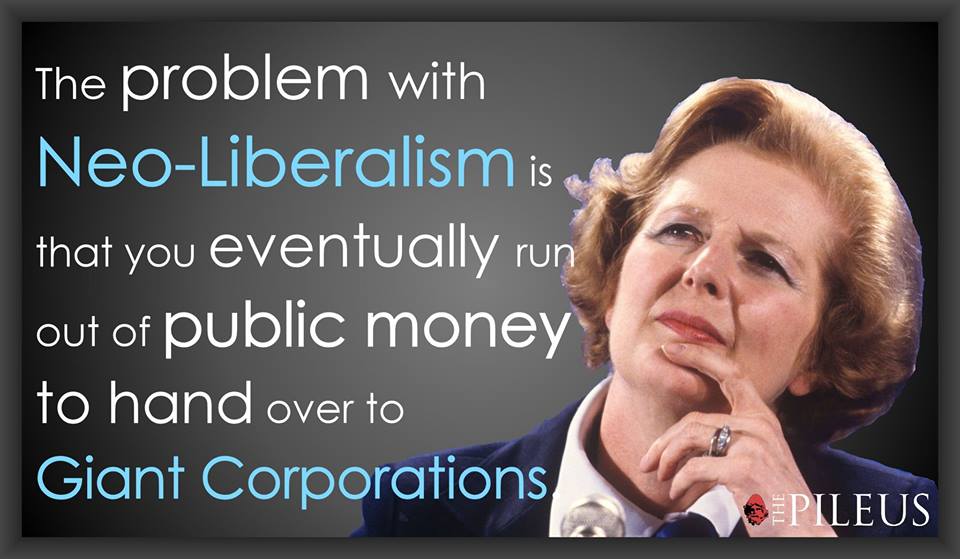

How Taxpayers Are Subsidising Corporate Profits Through Low Wages: Socialism For The Rich And Capitalism For The Poor

The UK’s welfare system is quietly propping up corporate profits by subsidising low wages, allowing some of the country’s most profitable businesses to get away with paying employees less than they need to live on. While government schemes like Universal Credit and the now-defunct Working Tax Credit were originally introduced to help struggling families, they have instead become a financial crutch for employers who refuse to pay a fair wage. The result? Billions of pounds of taxpayer money flowing into the pockets of big business under the guise of social support.

A System Built to Support Employers, Not Workers

Rather than ensuring businesses pay employees a living wage, the UK government has enabled a system where companies rely on state handouts to supplement wages. Research from Citizens UK estimates that taxpayers contribute over £11 billion annually to top up the incomes of low-paid workers. Instead of raising wages, many large corporations – especially in the retail, hospitality, and logistics sectors – continue to rake in massive profits while shifting the responsibility of fair pay onto the public purse.

Supermarkets, fast-food chains, and online retail giants are among the worst offenders. Despite generating billions in revenue, these companies pay frontline workers wages that are insufficient to cover basic living expenses. Amazon, for instance, has repeatedly been criticised for low wages and poor working conditions, all while boasting record profits. Similarly, major supermarket chains like Tesco and Sainsbury’s have distributed millions in dividends to shareholders while thousands of their employees rely on Universal Credit to survive.

The Hypocrisy of High Profits and Low Wages

If these companies were genuinely struggling, the argument that they “cannot afford” to pay higher wages might hold weight. But the truth is that many of these businesses are making record-breaking profits. In 2023 alone, UK supermarkets collectively made over £4 billion in profit, while fast-food chains like McDonald’s saw their UK revenue surge past £1.5 billion. And yet, countless employees in these industries are still paid below the real Living Wage, forcing them to depend on government support.

It’s a blatant contradiction: CEOs and shareholders enjoy rising dividends and multimillion-pound bonuses, while workers must rely on benefits to put food on the table. Instead of taking responsibility for fair wages, these companies continue to externalise their labour costs onto taxpayers, perpetuating a cycle of corporate greed disguised as economic necessity.

Government Complicity in Wage Suppression

While ministers claim to champion “hard-working families”, their policies tell a different story. The government’s refusal to enforce a meaningful increase in the minimum wage and failure to hold major employers accountable for fair pay only serve to maintain the status quo. The recent rise in the National Living Wage is little more than a token gesture, as it still falls below the real cost of living in many parts of the UK.

Instead of taking decisive action against low-paying employers, policymakers have allowed companies to exploit cheap labour with impunity. The result? An economic model where businesses pocket ever-growing profits, the government turns a blind eye, and ordinary taxpayers foot the bill.

The Real Solution: Make Employers Pay

If the government truly wanted to reduce the welfare bill and promote financial independence, the solution would be simple: force corporations to pay a fair wage. A legally enforced Real Living Wage, set according to actual living costs, would significantly reduce reliance on in-work benefits and ensure workers are paid fairly for their labour.

Additionally, introducing a corporate welfare tax on businesses that pay employees less than the living wage could help recover some of the billions taxpayers currently lose each year. If companies can afford to pay executives and shareholders millions, they can certainly afford to pay their staff a wage that allows them to live without state support.

Ending Corporate Welfare

The reality is stark: UK taxpayers are subsidising corporate profits, not struggling workers. This is not a question of economic feasibility; it is a question of corporate greed and government inaction. Until major businesses are forced to take responsibility for paying their employees a fair wage, taxpayers will continue to foot the bill for an exploitative system that prioritises shareholder returns over worker dignity. The government must stop enabling this injustice and ensure that those who generate the profits, i.e., workers, are no longer left to survive on state handouts while their employers thrive.