So the Greek parliament has submitted to the Troika ‘fiscal waterboarding’ and agreed to the terms of a new ‘bailout’ program that will tie the Greek economy to the rule of the Euro institutions and the IMF for at least three years. And will mean that the majority of Greeks will have austerity and reduced living standards imposed for the foreseeable future.

The rotten implications of the terms of this agreement have been ably critiqued by ex-Greek finance minister Yanis Varoufakis in a recent post of his (https://yanisvaroufakis.eu/2015/07/15/the-euro-summit-agreement-on-greece-annotated-by-yanis-varoufakis/). So in this post I want to consider the wider picture of the Euro project.

Back in late 1989, it was decided by France and Germany that they would go further than the European Union and move to a single currency union that aimed to create a trading and investment currency to rival the dollar and the yen. This would put Europe – or to be more exact Franco-German capital – on the global map as a major ‘player’. To make this work, at first 10 other European countries were persuaded to abandon their national currencies for the euro.

You see, the Euro project is really like a train. The train has an engine (Germany) and a conductor carriage (France) and then another ten coaches were attached. France was very keen to get even more coaches onto the train. Soon it was 15, then 18 and now 19 coaches.

The carrot was that these weaker European capitalist states would be able to benefit from integration in the euro area through convergence of their GDPs and living standards with the richer states. But to do so, the stick was that they first had to get their interest and inflation rates and their budget deficits and public debt ratios into certain agreed levels to ensure that the currency union would stick and the divergence of fiscal and monetary categories was not too great.

But none of them did, including Germany and France. Far from convergence taking place, the uneven development of capitalism merely compounded the divergence of the Euro economies in employment, productivity growth and inflation.

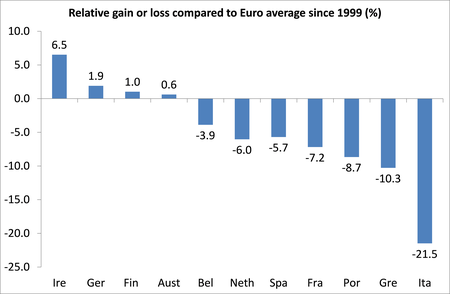

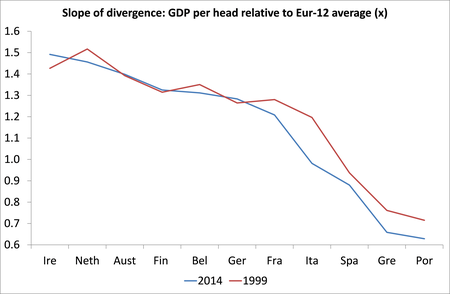

For example, if we look at the real GDP per person for the original Euro-12 states back in 1999 and compare it with 2014, (I’ve used the EU Commission AMECO database), we find that there has been further divergence in the last 15 years of the Euro project between the state with the highest GDP per person (Netherlands) and the one with the lowest (Portugal). And there has been more divergence because the weakest economies have fallen further behind, not closed the gap.

Indeed, since 1999, Italy’s real GDP per head has dropped by 21% compared to the Euro-12 average, while Ireland’s risen relatively by 6%.

But the Euro project went ahead anyway. All seemed well until the Global Financial Crash and the ensuing Great Recession.

This was like an avalanche that hit the Euro train and filled the coaches with varying degrees of debris.

The whole Euro train juddered to a halt.

The weight of the avalanche hit the weaker and tailing coaches more. Several coaches teetered on the edge of coming off the rails (Ireland, Portugal, Greece and Spain). Others juddered badly (Italy, Slovenia, Cyprus).

The avalanche left a huge pile of debt on the weaker Euro coaches. But instead of this debt being evenly distributed by the Euro engine and conductor up front so that the Euro coaches at the back could stay on track, the dirt at the front (crashing German and French banks) was bailed out and the burden heaped even more on the trailing coaches.

Eventually at expense of labour and the taxpayers of the weakest coaches, the trailing struggled back onto the track and the Euro train moved off again, very slowly.

But not Greece. It was just too weak and too weighed down by the dirt of the avalanche. Clearly it should never have been on the end of the Euro train. But it was and now it was like a carriage flailing along at the back as the train moved off again.

Instead of helping it out by reducing the weight of dirt (debt) it had, the German engine and French conductor piled even more debt on it. Other coaches were pleased because they were weighed down already and did not want any more dirt (debt) from Greece.

Instead of helping it out by reducing the weight of dirt (debt) it had, the German engine and French conductor piled even more debt on it. Other coaches were pleased because they were weighed down already and did not want any more dirt (debt) from Greece.

Eventually, the German engine started to think the best thing was to just cut off the Greek carriage so the Euro train could get going again. But it was persuaded by the French conductor (and other worried coaches who thought that they could be next), that the Greek coach should be allowed to stay connected.

Apparently, the German engine and French conductor, along with one set of rail inspectors (EU Commission) are hoping that the Greek coach will get stronger because it must carry more dirt. But this policy has failed on two previous occasions.

Another rail inspector (the IMF) now reckons that putting more debt onto the Greek coach will only make things worse. But the EU Commission and the Germans are resisting their solution of shifting some of that dirt onto the other carriages to lighten the load for the Greek coach.

The latest IMF report on Greek debt sustainability makes it clear that unless the size of Greek public debt is cut by at least 30% of GDP and the time for clearing the rest is put back for up to 30 years, then the burden will be too much for Greece (cr15186). The debt ratio will actually rise from the current 180% of GDP to over 200% of GDP, or more than double the level that Greece started with in the crisis back in 2010. The Greek carriage, already flailing at the back of the Euro train, will fall off.

In contrast, the latest EU Commission report argues that things are not that bad

(2015-07-10_greece_art__13_eligibility_assessment_esm_en).

That’s because the debt repayment burden has already been put back until 2022 and annual debt servicing costs for Greece are only 2% of its GDP, very low and even lower than other coaches like Portugal or Ireland are paying.

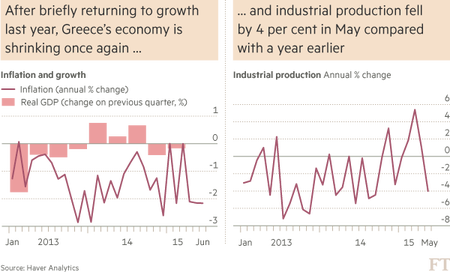

The problem with this argument is that even 2% of GDP servicing a year requires at least 2% growth a year and even that would only stabilise the debt, not reduce it. The weight of the dirt on the Greek coach would remain the same. But the Greek economy is not growing at even 2% a year. On the contrary.

The Troika is demanding that the Greek government run a surplus on its budget before those debt interest costs of 3.5% of GDP a year. This is so it can repay the debt owed to the ECB and the IMF by 2018. And the latest Troika package imposed on the Greeks includes €13bn of government spending cuts and tax rises (VAT) etc. This will only drive the economy even further down. One estimate is that the Greek economy will be 4.8% smaller than it otherwise would have been by 2018 (the end of the new bailout program) because of the new austerity measures.

Yet again the cruel irony of the latest Troika package is that 90% of the huge €82bn of bailout funds will be used to recapitalise ailing Greek private sector banks; repay the IMF, the ECB and other creditors. Only €8-12bn will be available to fund the government budget deficit over three years. So, of a bailout fund of nearly 40% of annual Greek GDP, only 4% will go to the Greek people over three years.

Some argue that the bailout will work as some of the money will go to Greek banks and they can start lending again; bank deposits will come back; capital flight will reverse and government arrears will be paid up. Maybe so, but that will only get things back to where they were before the tortuous negotiations began last February. From then on, the issue of faster growth will depend on Greek capitalists investing, along with an influx of foreign capital. Can we really expect that? The EU says it will provide up to €35bn in new investment. But most of this would come from existing funds anyway – it’s not new. And it constitutes at most just 3-5% of GDP a year if it materialises, while austerity measures are hitting the economy at 3-4% of GDP for the first two years.

So the Greek coach is likely to remain an annoying burden at the end of the Euro train. German finance minister Schauble is right in one way. It should be detached so that the Euro train can move on. But that argument could also be applied to other coaches.

And here is the rub. The Euro train is struggling to move along the track anyway. Real GDP growth is weak, even at the front of the train. And there is no intention of sharing the burden of recovery or future crises with fiscal transfers from the richer states to the poor, as in a proper federation or fiscal union (see my post,https://thenextrecession.wordpress.com/2015/02/12/red-lines-and-fiscal-union/).

Worse, it’s now seven years since the start of the Great Recession that exposed this Euro train mess. Recessions seem to come along pretty regularly every 8-10 years. So the Eurozone could be heading for a fall again well before the Greek bailout program is completed in 2018.

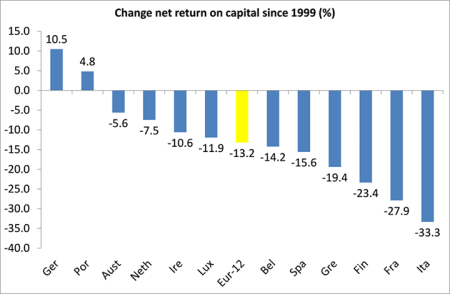

Moreover, the problem of poor profitability of capital remains – indeed, profitability of capital in the Eurozone states has dropped dramatically in the last 15 years. Only Germany has benefited from the Euro train.

Private and public sector debt remains at record levels. If the Euro train stays in the tunnel of depression and even hits a new blockage on the track….

…. it may not stay as one unit any longer.