Fourteen local authorities have filed legal claims in the High Court, alleging fraudulent Barclays manipulation of LIBOR rates has cost them millions of pounds on controversial LOBO loans. The Councils are Bristol, Bradford, Greater Manchester, Kirklees, Leeds, Liverpool, Newcastle, North East Lincolnshire, Nottingham, Oldham, Sheffield, South Gloucestershire, Walsall and West Yorkshire.

Commenting for Debt Resistance UK, campaigner Joel Benjamin said:

“Having campaigned for councils to file fraud cases against the banks since 2014, we are thrilled Councils have finally stepped in to protect local taxpayers by filing fraud claims against banks which brought our economy to the brink. 10 years after the crash, its Town Councils now facing bankruptcy to pay for the bankers bailouts.

We know 240 councils have rip-off LOBO loans. We’re now calling on the other 224 Councils with LOBO loans to file legal action against Barclays, RBS, Dexia, ICAP, Tullet Prebon and CAPITA.”

Barclays fraud cases will quickly draw in other parties to the LOBOs, namely Treasury Advisors CAPITA and Butlers/ICAP who recommended Councils enter LOBO loans in exchange for fat undeclared fees and brokers ICAP and Tullet Prebon who paid the large kickbacks on LOBO deals.

Rob Carver, a former Barclays derivatives trader told the Communities and Local Government inquiry in 2015:

“The one thing I will say is that essentially the bank is taking the other side of this trade. We would not have done the trade the other way round, partly because of the losses we would have made on day one, as discussed. Also, the nature of the risk itself means it is the kind of risk that makes traders and hedge fund managers, as I also used to be in the past, wake up at night screaming. It is just horrible stuff.

My personal feeling was that I would not do these deals if you put a gun to my head. I asked myself, when I was doing this job, why local authorities are doing them? There is a chain of fees that flow from the councils to treasury management advisers to brokerage houses, like ICAP, to advise them and protect them against potentially being mis‑sold these products, or whatever you want to call it.

We were paying commissions to the brokers as well and this made me very concerned, because I did not see how the brokers could be giving their ultimate clients, the councils, independent advice when they were being paid by us. Subsequently I found out they were also being paid by the councils as well. The brokerage fees were quite large compared with the fees we normally paid, and there was lots of pressure always to pay higher fees. It smelt and felt to me like there was something really dodgy going on.”

Councils say the loans – entered into between 2004 and 2010 – should be rescinded with fees returned. They also want compensation for damages.

Ludovica Rogers from Debt Resistance UK says:

“Many of the councils where legal challenges were filed, including Leeds, Liverpool, Bristol, Manchester, Oldham and Sheffield are councils where Debt Resistance UK has helped local residents to file formal objections to LOBO loans. The external auditors of these councils have failed to act on LOBO loans, conducting a cover-up to protect the banks, brokers and advisors involved.”

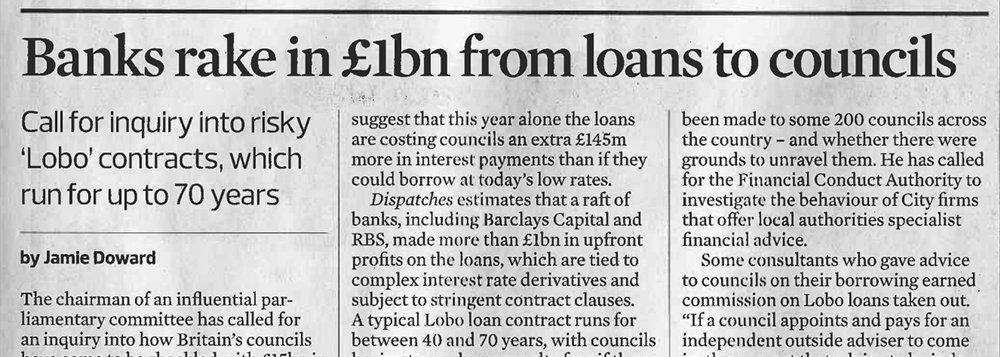

At least 240 councils across the UK have taken out LOBO loans, totalling £15bn. External auditors are currently considering legal objections from residents in more than 50 councils, filed under the Audit Commission Act last year, which could result in some LOBO loans being ruled unlawful. External auditors must now act in the public interest.

Find out more about LOBO loans and if your council has them on the Debt Resistance UK website.