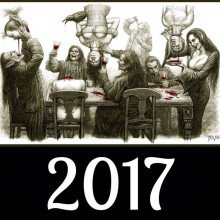

The following can be used as a source to support key facts about the dramatic impact the current Conservative government has had on the population of the UK and also as an educational resource.

All data is extrapolated from reliable sources in which the corporate media has been entirely avoided. Some will continue to deny the evidence but that will always be the case.

Just keep telling it how it is…

Key Facts:

127,600 homeless children

9,000 rough sleepers

1.9m pensioners in poverty

Dementia Tax floated

4m children in poverty

2,000+ Food Banks

ESA cut by £30 a week

Universal Credit in chaos

120,000 deaths linked to austerity

Children and Housing (Shelter)

1.6 million children in Britain live in housing that is overcrowded, temporary, or run-down. Some live in housing that’s making them ill. Many are missing out on a decent education. Others suffer chronic insecurity, shuffled from place to place in temporary accommodation.

Shelter strongly believes that access to decent affordable housing must be at the heart of any strategy for improving the life chances of children and young people and reducing child poverty.

Shelter Children’s Service is a completed pilot programme of work which focused on the needs of homeless and badly housed children. Information on this work and useful resources can be found on these pages.

Rough Sleeping (Homelessness.UK)

How many people sleep rough each night?

According to the latest figures, collected in the autumn of 2016 and published in January 2017, 4,134 people are estimated to be sleeping rough on any one night.

Is rough sleeping on the rise?

There was an increase of 16% from 2015 to 2016, while since 2010 rough sleeping estimates show an increase of 134%.

Which areas saw the biggest increases?

The East of England has seen the biggest percentage increase in rough sleeping since last year (44%). This is followed by the North West (42%), the East Midlands (23%) and the North East (18%), all of which have seen increases in rough sleeping above the national average.

Pensioners in Poverty (Help the Aged)

Britain’s record on tackling poverty has reached a turning point and is at risk of unravelling, following the first sustained rises in pensioner and child poverty for two decades, according to a new report by the Joseph Rowntree Foundation.

Almost 300,000 more pensioners and 400,000 more children are now living in poverty than in 2012/13. Since that year, there have been continued increases in poverty, across both age groups. Very little progress has been made in reducing poverty among working-age adults too.

The warning comes in a state of the nation report by the independent Joseph Rowntree Foundation (JRF), the leading authority on poverty in the UK. UK Poverty 2017 examines how UK poverty has changed over the last 20 years, providing the most comprehensive and up-to-date picture of the challenges and prospects facing low income families in modern Britain.

Campbell Robb, chief executive of the independent Joseph Rowntree Foundation, emphasised how worrying the current situation is. He said: ‘Political choices, wage stagnation and economic uncertainty mean that hundreds of thousands more people are now struggling to make ends meet. This is a very real warning sign that our hard-fought progress is in peril.

‘Action to tackle child and pensioner poverty has provided millions of families with better living standards and financial security. However record employment is not leading to lower poverty, changes to benefits and tax credits are reducing incomes and crippling costs are squeezing budgets to breaking point. The Budget offered little to ease the strain and put low income households’ finances on a firmer footing.

‘As we prepare to leave the EU, we have to make sure that our country and our economy works for everyone and doesn’t leave even more people behind.’

Rising pensioner poverty

In 1994/95, 28% of pensioners lived in poverty, falling to 13% in 2011/12 – a fall achieved by extra help for poorer pensioners.

Following the financial crisis of 2007/8 poverty rates remained stable. A combination of benefit policies and spells of low inflation helped negate the worst effects of the downturn for the least well-off pensioners.

But changes to welfare policy – especially since the 2015 Budget – are reducing households’ financial breathing space.

Pensioner poverty rates rose to 16% last year suggesting previous progress tackling poverty is at risk of being lost without immediate action. 14 million people live in poverty in the UK – over one in five of the population – including 1.9 million pensioners.

Without government action, pensioner poverty could continue to rise

Caroline Abrahams, Charity Director at Age UK, agreed that these signs of rising pensioner poverty are extremely worrying.

She said: ‘With one in six pensioners (around 1.9 million) now living in poverty, not including the many thousands more who are just above this threshold and still struggling to make ends meet, the Government clearly needs to do far more. Unless action is taken quickly, poverty among the older generation could continue to escalate, undermining all of the progress that’s been made following the introduction of measures such as the pension credit and triple lock.

‘Clearly the time for complacency is over and there can be no doubt that, given the current situation, the state pension remains a vital tool in the fight against pensioner poverty, giving millions of older people a small element of financial security in an increasingly uncertain world.

£3.5 billion of money benefits for older people still go unclaimed

Abrahams continued: ‘It’s hard to believe but despite such high number of pensioners living in and just above the poverty line, as much as £3.5 billion in money benefits remains unclaimed by older people every year.

‘We would urge any older person who is worried about money to get in touch with Age UK by calling our advice line free of charge on 0800 169 6565 or visiting www.ageuk.org.uk/benefits for free information and advice. Claiming the benefits that they’re entitled to could make a big difference to their income.’

Are members of the public aware of the cost of dementia care? (Alzheimer’s Society)

Recent Alzheimer’s Society polling of the general public has highlighted that people are increasingly aware of and worried about the challenges in the current care system:

- The public see social care as an increasingly important issue facing the country, polling above education, crime, the environment, welfare benefits and pensions.

- 63% of people have told us they are worried that any savings they have will be spent on care and that they would have nothing to leave to pass on their children or loved ones.

- 72% of people feel worried, angry or frightened about the possibility of losing their home to pay for social care if they developed dementia.

- 81% of people say they feel angry, worried or frightened about the Government not addressing the issue of social care, which represents a 10% rise since June.

Child Poverty Facts and Figures (Child Poverty Action Group)

Poverty affects one in four children in the UK today. When kids grow up poor they miss out – and so do the rest of us. They miss out on the things most children take for granted: warm clothes, school trips, having friends over for tea. They do less well at school and earn less as adults.

Any family can fall on hard times and find it difficult to make ends meet. But poverty isn’t inevitable. With the right policies every child can have the opportunity to do well in life, and we all share the rewards of having a stronger economy and a healthier, fairer society.

- There were 4 million children living in poverty in the UK in 2015-16. That’s 30 per cent of children, or 9 in a classroom of 30.1

- London is the area with the highest rates of child poverty in the country.2 You can see child poverty rates by local area by visiting End Child Poverty.

- Child poverty reduced dramatically between 1998/9-2011/12 when 800,000 children were lifted out of poverty.

- Work does not provide a guaranteed route out of poverty in the UK. Two-thirds (67 per cent) of children growing up in poverty live in a family where at least one person works.3

- Children in large families are at a far greater risk of living in poverty – 36% of children in poverty live in families with three or more children.4

- Families experience poverty for many reasons, but its fundamental cause is not having enough money to cope with the circumstances in which they are living. A family might move into poverty because of a rise in living costs, a drop in earnings through job loss or benefit changes.5

- Child poverty blights childhoods. Growing up in poverty means being cold, going hungry, not being able to join in activities with friends. For example, 59 per cent of families in the bottom income quintile would like, but cannot afford, to take their children on holiday for one week a year.6

- Child poverty has long-lasting effects. By GCSE, there is a 28 per cent gap between children receiving free school meals and their wealthier peers in terms of the number achieving at least 5 A*-C GCSE grades.7

- Poverty is also related to more complicated health histories over the course of a lifetime, again influencing earnings as well as the overall quality – and indeed length – of life. Men in the most deprived areas of England have a life expectancy 9.2 years shorter than men in the least deprived areas. They also spend 14% less of their life in good health.8 Women share similar statistics.

- Child poverty imposes costs on broader society – estimated to be at least £29 billion a year.9 Governments forgo prospective revenues as well as commit themselves to providing services in the future if they fail to address child poverty in the here and now.

- Childcare and housing are two of the costs that take the biggest toll on families’ budgets. When you account for childcare costs, an extra 130,000 children are pushed into poverty.10

(Updated November 2017. All poverty figures are after housing costs, except where otherwise indicated)

- 1.Households Below Average Income, An analysis of the income distribution 1994/95 – 2015/16, Tables 4a and 4b. Department for Work and Pensions, 2017.

- 2.Households Below Average Income, An analysis of the income distribution 1994/95 – 2015/16, Table 4.16ts. Department for Work and Pensions, 2017.

- 3.Households Below Average Income, An analysis of the income distribution 1994/95 – 2015/16, Table 4.6ts. Department for Work and Pensions, 2017.

- 4.Households Below Average Income, An analysis of the income distribution 1994/95 – 2015/16, Table 4.8ts. Department for Work and Pensions, 2017.

- 5.Child poverty transitions: exploring the routes into and out of poverty 2009 to 2012, Department for Work and Pensions, 2015.

- 6.Households Below Average Income, An analysis of the income distribution 1994/95 – 2015/16, Table 4.7db. Department for Work and Pensions, 2017.

- 7.GCSE and equivalent attainment by pupil characteristics: 2014. Department for Education, February 2015.

- 8.Inequality in Healthy Life Expectancy at Birth by National Deciles of Area Deprivation: England, 2009-11. Office for National Statistics, Statistical Bulletin. 14 March 2014.

- 9. D Hirsch, Estimating the costs of child poverty. Child Poverty Action Group. 2013

- 10. D Hirsch and L Valadez. How much does the official measure of child poverty under-estimate its extent by failing to take account of childcare costs? June 2015.

UK foodbank use continues to rise (The Trussell Trust)

UK foodbank use continues to rise according to new data from anti-poverty charity, The Trussell Trust. Between 1stApril 2016 and 31stMarch 2017, The Trussell Trust’s Foodbank Network provided 1,182,954 three day emergency food supplies to people in crisis compared to 1,109,309 in 2015-16. Of this number, 436,938 went to children. This is a measure of volume rather than unique users, and on average, people needed two foodbank referrals in the last year.* [see notes to editor]

The charity’s new report, Early Warnings: Universal Credit and Foodbanks, highlights that although the rollout of the new Universal Credit system for administering benefits has been piecemeal so far, foodbanks in areas of partial or full rollout are reporting significant problems with its impact.

Key findings from the report reveal:

- Foodbanks in areas of full Universal Credit rollout to single people, couples and families, have seen a 16.85% average increase in referrals for emergency food, more than double the national average of 6.64%.

- The effect of a 6+ week waiting period for a first Universal Credit payment can be serious, leading to foodbank referrals, debt, mental health issues, rent arrears and eviction. These effects can last even after people receive their Universal Credit payments, as bills and debts pile up.

- People in insecure or seasonal work are particularly affected, suggesting the work incentives in Universal Credit are not yet helping everyone.

- Navigating the online system can be difficult for people struggling with computers or unable to afford telephone helplines. In some cases, the system does not register people’s claims correctly, invalidating it.

- Foodbanks are working hard to stop people going hungry in areas of rollout, by providing food and support for more than two visits to the foodbank and working closely with other charities to provide holistic support. However, foodbanks have concerns about the extra pressure this puts on food donation stocks and volunteers’ time and emotional welfare.

Trussell Trust data also reveals that benefit delays and changes remain the biggest cause of referral to a foodbank, accounting for 43 percent of all referrals (26 percent benefit delay; 17 percent benefit change), a slight rise on last year’s 42 percent. Low income has also risen as a referral cause from 23 percent to 26 percent.

ESA claimants owed up to £500 million due to DWP error (Disability Rights UK)

The BBC understands that assessors wrongly calculated the income of around 75,000 claimants.

Mistakes began in 2011 when the Government started moving incapacity benefit claimants onto the new ESA benefit.

The DWP said it only became aware of the problem in December 2016 after the Office for National Statistics published fraud and error figures for the social security system.

While it says it is still trying to understand the scale of the problems with ESA, which is paid to about 2.5 million people it will contact anyone affected.

Frank Field MP, Chair of the Commons Work and Pensions Select Committee said the ESA problem was on a scale of “historic proportions” and added:

“I’m still gobsmacked at the size and the nature and the extent and the coverage of people that have been wrongly impoverished by the department getting it wrong.”

In March 2017, the National Association of Welfare Rights Advisers (NAWRA) wrote to the then Secretary of State for Work and Pensions,

Damian Green to raise concerns about the DWP’s failure to follow correct legal procedures on conversion of incapacity benefit claimants to ESA:

“Our members have identified many former Incapacity Benefit/Severe Disablement Allowance claimants who have been migrated to Employment and Support Allowance (ESA), and only been awarded contributory ESA as the DWP have failed to apply the regulations and their own guidance and undertake a financial assessment to check entitlement to any top up of Income Related ESA.

The migration process started in March 2011 and we are calling on the DWP to revisit all claimants nationally where they failed to adhere to the legal requirement and their own guidance and assess them any entitlement to an income related top up.

Many of our members have taken up cases in respect of individual claimants and found that they have been underpaid by thousands of pounds.

This is only the claimants that have been in a position to obtain advice. There are likely thousands more who have had their benefit incorrectly calculated due to DWP failing to follow the law. NAWRA believes that the DWP is obliged to correct those cases and seeks to ensure that the DWP trawl all cases to pick up any outstanding errors of law.”

NAWRA then sent a similar follow-up letter to the current Secretary of State David Gauke in July 2017.

Last month NAWRA received a response from David Gauke confirming DWP officials are currently investigating this matter and will be in contact once they have completed this work.

A DWP spokesperson said:

“We’re aware of this issue and are currently reviewing the historical benefit payments of claimants.

We’ve already contacted some of the people affected and are making repayments. Anyone potentially affected will be contacted by the department.”

The BBC understands that the DWP has contacted about 1,000 people so far.

For further information see https://www.bbc.co.uk/news/uk-42012116

Please also see https://www.nawra.org.uk/index.php/ib-and-esa-conversion-letter-to-damien-green-mp/ and https://www.nawra.org.uk/index.php/letter-to-secretary-of-state-for-work-and-pensions-about-income-related-esa/

Committee publishes ‘damning’ new Universal Credit evidence (www.parliament.uk)

Committee Chair Frank Field MP calls evidence submitted to the Committee by Halton Housing Trust the “most damning” he has ever read on what he describes as Department for Work and Pensions “maladministration.”

Food bank referrals double

The Trust has accumulated over £400,000 of arrears as a direct result of the rollout of Full Service Universal Credit. This means that just 18% of its tenants owe 55% of all its arrears.Over the last 12 months the number of referrals the Trust has made to local food banks has more than doubled.

The Trust reports on the frequent wrong categorisation of benefit claimants’ eligibility for Advance Payments while Universal Credit is being processed.

In a sample of 1,252 tenants the Trust found that the majority of claimants were eligible for a Benefit Transfer Advance as they were moving from a so-called legacy benefit (like Jobseeker’s Allowance) onto Universal Credit. This is paid back during the first 12 months of a Universal Credit claim.

Advance payments issues

Those claimants who were offered Advance Payments were offered a New Claims Advance that had to be paid back within 6 months: the submission details the even bigger financial problems this caused for families. In addition, the evidence reports:

- The Department refuses to amend the recovery period of the Advance Payment, from 6 months to 12 months, even in the instances where they acknowledge that the claimants should have had a Benefit Transfer Advance.

- Recovery of the Advance Payment commences immediately with the first Universal Credit payment. This means claimants are continuously playing catch up and are instantly put in debt when the repayment is deducted.

- As the Advance Payment of either kind are recovered directly from the Universal Credit award, they are being given priority over other essential/actual priority outgoings.

- When Advanced Payments have been provided there is a lack of any explanation to the customer that this includes a personal allowance and housing cost element. In many cases customers are unsure as to what the money they are receiving is for or what the levels of Advance will be.

Personal budgeting advice unavailable

Despite the Department advertising the availability of personal budgeting advice:

- Halton Housing Trust found that this advice was not available to the vast majority of applicants. This is despite it being an essential element for many applicants at the start of the Universal Credit application process.

- Local Authorities have been awarded funding to offer Personal Budgeting Support. Despite this, the number of referrals made by the Department locally in Halton has been very low.

Lack of coordinated approach

Further examples cited by the Trust include:

- Many employers choose to pay their employees early before the Christmas period. The Universal Credit regulations consider this as an increase in income and not an early payment. This triggers a review of their claim, with no payments being made until the end of the subsequent month (January).

- A lack of coordinated approach between the NHS and DWP. The Trust has recently supported a tenant who received a £50 fine for ticking the “JSA” box on a prescription form, because the form has not been updated with a “Universal Credit” option for receiving free prescriptions, and there are no plans to do so

- The Universal Credit application prompts a cessation of Healthy Start vouchers if the claimants were previously in receipt along with their legacy benefit. The Healthy Start system does not yet recognise Full Service Universal Credit.

‘Throwing claimants’ finances into chaos’

Committee Chair, Rt Hon Frank Field MP, said:

“It would be difficult to think, in all my period of Chair of the Select Committee, of a piece of evidence that is so damning on the DWP maladministration which is mangling poorer people’s lives. This maladministration is throwing Universal Credit claimants’ finances into chaos.”

Is austerity linked to 120,000 unnecessary deaths? (Full Fact)

An academic paper has estimated there were around 120,000 more deaths in total between 2010 and 2017 than there would have been had the mortality rate between 2001 and 2010 continued. Restrictions on health and social care spending is one of a number of possible explanations for this, and the findings need to be treated with a bit of caution.